With the 2020 US election is right around the corner, we looked at the impact of presidential election on FX markets. Several studies in the past have analysed the effect of macroeconomic performance on the outcome of the presidential election. The consensus is that the macroeconomic performance is a reliable predictor of the election outcome.

The political risk is returning to the spotlight as one possible driver capable of breaking the fragile state that global economy lies in at the moment. Since the Brexit referendum and the 2016 US election, the two major upsets during the turbulent 2016, FX option markets have been touchy about the issue of political event risk premium.

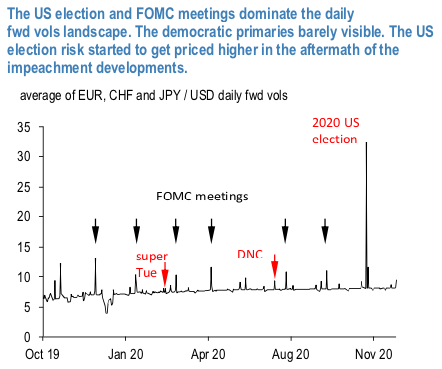

The upcoming 2020 US election pricing are gearing to be one of the most eventful in history and the notable uptick in FX options pricing of that risk since the impeachment developments comes at the 13 months mark before the election day, well ahead of any of the previous elections.

The daily fwd vols landscape in the 1st figure is clearly dominated by the US election risk premium. The democratic primaries are lost in the background noise. We expect them to gain more day weight as the democratic field narrows and the investors’ interest intensifies.

On the surface an eye catching, pricing disparities across USD pairs in the 2nd figure can be rationalized with: 1) cable’s Brexit fixation explains the lack of the US election premium, 2) CEE pricing reflects the EUR proximity, 3) the cheap election vols in some of the EM high yielders could become an opportunity only once the 1Y tenor crosses the Nov 4th election dateline, and 4) liquidity in fwd vols has been a sticking point that forced the willing investors into JPY, EUR and CHF.

In order to assess a fair value of election risk we compare the current 2020 US election pricing with four recent election events and study the theoretical profitability of entering into event risk FVA selling. FVAs considered are 1M in tenor with forward start date set 1-week before the event, which strike a decent compromise between isolating event risk and ensuring realistic pricing. The 3rd figure summarizes the analysis and establishes a rough rule of thumb for pricing of election risk.

When 1m FVAs (containing election event) vs ATM pricing ratios exceeds 1.6X the election risk is getting overpriced. Thus, at 1.3X (refer 3rd figure) the current pricing of the US 2020 election is indicating still 15-20vols more headroom in the overnights.

Wells Fargo reckons that although there is plethora of anecdotal evidence and theoretical support for the notion that election years lead to uncertainty and, in turn, dampened economic activity, their stances of the last 70 years of economic data gives little support for this hypothesis. Academic literature does seem to suggest that uncertainty can negate the economic performance, but polls uncertainty does not appear to be significant or persistent enough to create a pattern across the past 18 U.S. presidential election cycles. Having said that, if the heightened policy uncertainty seen in the more recent elections becomes the norm, effects on the real economy could become clearer in the aggregate data. Courtesy: JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures