This write is majorly emphasizes on a bearish EURCHF owing to Euro area politics:

This recommendation has been motivated by EUR facing multiple electoral hurdles in 2017 on the one hand, and constraints to SNB FX interventions on the other. The latest key event in Euro area was the Italian referendum on December 4th. While the ‘no’ vote was expected, the margin by which it won was larger than expected.

Longer-dated EUR implied vols, especially expiries spanning the Dutch and French elections should, however, prove to be a more reliable.

For now, the major risk for the euro is from Italy is the possibility of early snap elections and the events of this week have reinforced this view with the President’s comments indicating that a new general election can take place only after the mutually consistent electoral laws are put in place.

We think that a continuation of the current majority of PD and small centrist parties is the most likely outcome, with a mandate to form a new government as soon as on Monday. Our central view for 2017 has been that unless one can reasonably see an outright majority for populists next year, these events create more volatility than trend for the euro.

We are looking for modest concession in EUR (EURUSD down to 1.04 on higher US rates and politics) and recommend positioning for this via EURCHF instead (Has the Euro outgrown political risk?). The earlier than expected ECB taper was admittedly a hawkish surprise, but our bullish view on EUR were mostly concentrated in H2’17 on the view that this is when a harder taper would occur.

With the ECB meeting now behind us and unlikely to be a driver of valuations in the near term, the focus should turn to politics again. The trade is also helped from the Swiss leg since SNB should eventually taper its FX purchases as well.

The SNB response to EURCHF breaching 1.08 was not only belated, but also smaller than usual and our expectation is that the global political appetite for systematic and continuous FX intervention will be limited.

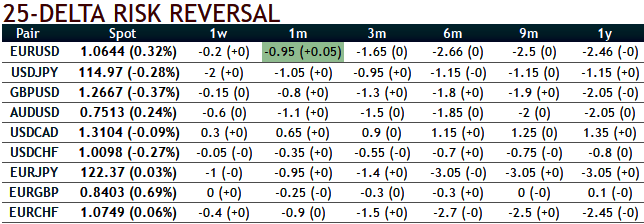

Negative flashes delta risk reversals would imply the mounting hedging sentiments in the bearish trend of the pair. The hedging position for euro crosses is naturally long vega on the downside and short on the topside, fitting with the volatility market dynamics (see nutshell showing IVs and RR). Hence, 3m risk reversals of euro crosses. Stay short in 3m EURCHF vanilla option structures (bearish at levels 1.0840 months ago), marked at -0.35%.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures