Europe’s economic heart is pumping away and a 0.8% Q3 QoQ GDP gain in Germany threatens to nudge the Eurozone growth rate up too.

It’s a reminder of the changing of the guard as the US economic cycle ages and has given the euro a bit of a bid this morning as a backdrop for the marquee panel at today’s ECB Conference in Frankfurt, with Messrs Draghi, Yellen, Kuroda, and Yellen on stage.

EURUSD 1.1880 is the key level according to Stephanie, but the big challenge comes from the failure of the recent chop to lighten speculative euro long positions.

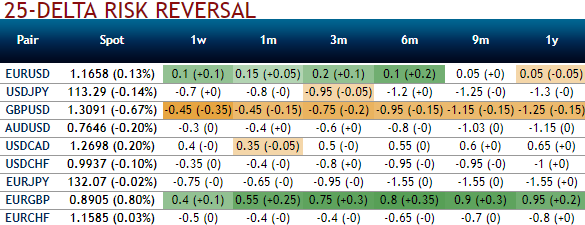

Please be noted that the risk reversals of EURJPY across all tenors are still indicating bearish risks, while positively skewed IVs of the same tenor signifies the hedgers’ interests in OTM put strikes upto 129 levels.

On the flip side, if you look at the technical chart of this pair, the major trend has been rising higher. The technical trend indicators have also been substantiating the continuation in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Fundamentally, the historical experience from valuation frameworks suggests that euro valuations are not yet a constraint for further strengthening. On long-term valuation metrics, even though the euro has strengthened by 15% in TWI terms since the post-QE bottom, historical experience from other major currencies where markets perceived an impending end of QE programs showed a larger, 26% strengthening in TWI on average.

Hence, keeping both fundamental and technical factors in mind, it is advisable to initiate below relative value trades.

Sell 6M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Buy 3M 30D EUR puts/JPY calls vs. sell 3M 28D EUR puts/KRW calls.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 124 levels (which is highly bullish), while hourly JPY spot index was at shy above 3 (neutral) while articulating (at 11:00 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data