For risk-averse, a 2m digital put strike 1.0750 KO 1.0450, This cheap option (costing 11% at that time) is now in the money and will expire right after the December Fed meeting (already priced). Though a scenario of further euro downside would be gradual, the risk of hitting the barrier is much higher post-Trump’s election.

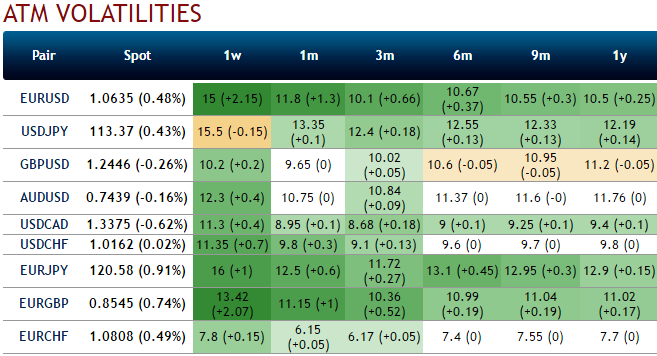

For positional traders Reverse Put Spreads are recommended: We see option writers would be on the competitive advantage as you could probably make out from the nutshell showing implied volatilities of ATM contracts of 1w expiries are considerably reducing comparing to the longer tenors The dollar has surged again, the dollar gains come from three fronts, they are: rising crude prices, Trumps robust fiscal policies favouring dollar strength and healthy set of economic numbers.

As a result, we’re now seeing turbulence in euro’s OTC markets, the implied volatility of ATM contracts for 1w and near month expiries of EURUSD are spiking sky rocketed at around 15% and 11.8% respectively which is the highest among G7 currency space.

While delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for upside risks over 1 week’s time, while long-term robust bearish sentiments remain intact.

Hence, 1w/2m reverse put spreads with strikes 1.07/1.0/1.0650/1.06 in 2:1 ratios, the option structures resembling these types with longer tenors are also encouraged.

Buying digital puts for aggressive bears: This trade is a vanilla 6m European digital put with a strike at 0.97. This option likely to deliver its notional amount if EURUSD trades below this level at the expiry, a pay-off of nearly eight times the premium amount. It can be replicated by a very tight put spread and is, therefore, taking advantage of the high skew.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data