In the Scandi FX sphere, EURNOK to get an extra impetus as the major focus for this week would be the Norges Bank (NB) meeting on Thursday after recent OPEC's booster, where we expect NB to lower its rate path for 2017 by 10-15bp and thereby imply almost a 100% probability of a rate cut next year.

We do not expect NB to cut further and we think that a dovish rate path along with the usual worsening of the liquidity situation going into end year could lead to some temporary upside support in EURNOK – especially after the past couple of days’ decline on the back of the OPEC deal.

All these factors leave us structurally bullish on NOK which we are positioned for outright via short EURNOK outright.

This week the central bank confirmed that it will keep rates on hold. The key sentence from the Norges Bank’s statement is that ‘overall developments since September do not differ substantially from the projections in the September MPR’.

This was a relief for NOK as it indicates that the central bank is not over-reacting to the decline in inflation (core is 0.35% lower than the NB had expected). The key risk for NOK will now be the OPEC meetings and the currency has underperformed this week amid lower oil prices.

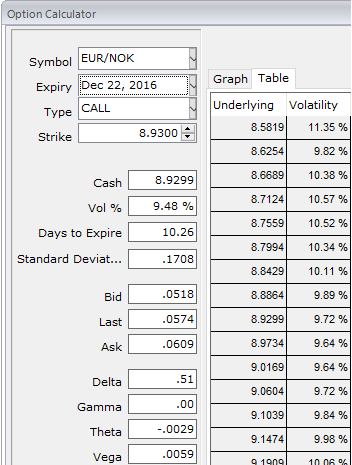

In terms of EURNOK, we now see good chances of challenging the countertrend rally target at 9.6100/9.6275.

10D EURSEK ATM implied volatility are spiking considerably on account recent ECB’s monetary policy announcement and ahead of Swedish inflation data, it is just a tad below 9.5% which is quite conducive for both option writers and holders as we could see short-term upswing possibilities and medium term bearish risks.

We know that the option contracts with a higher IVs would be expensive. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. Option writer wants IV to shrink so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Hence, we advocate diagonal credit put spreads to monitor swings on either way, to execute this option strategy one can short 1W (1%) ITM put while buying 1M (0.5%) OTM put option; the strategy could be executed at a net credit.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data