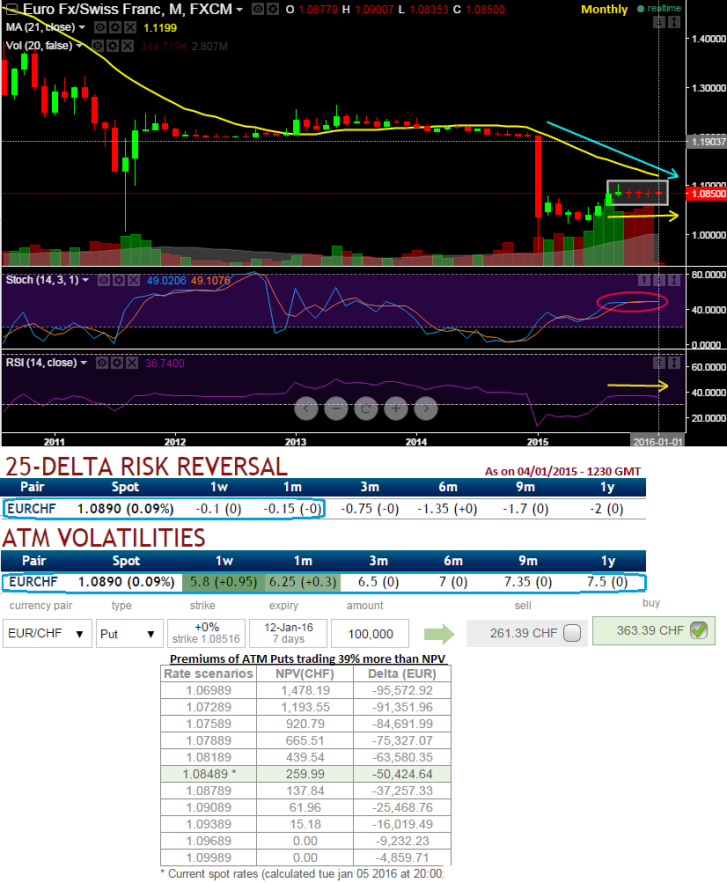

Fistly, delta risk reversals of EURCHF for next 1W-1M month: The hedging arrangements don't seem to be more aggressive on either direction but slight worry is seen on downside risks over next 1w - 1m time horizon and as a result delta risk reversal for EURCHF has been creeping into negative figures.

From the nutshell, 25-delta risk of reversals of EUR/CHF indicates puts have been comparatively overpriced.

Secondly, for instance, suppose we've chosen an at the money put option of EURCHF with 1W expiry and with this given maturity has been creeping up but just shy below 6% which is negligible for option writers.

It is likely to remain on lower side (historically these vols have never disappointed), whereas ATM puts are overpriced over 39% more than NPV. So with this disparity we like to advocate below trading in option combination so as to gain the cost advantage and ensure certain returns even in this tight range.

Lastly, daily technicals suggest lackluster movements (see grey shaded areas for range-bounded zone) but slightly bearish bias after a formation of shooting star at peaks of 1.0875 levels.

While leading indicators moving in linear direction, no divergence to this range bounded trend. But more notably you figure out a huge volume confirms these trivial bearish swings to prolong.

FxWirePro: EUR/CHF IVs moving in sync with risk reversals and technicals

Tuesday, January 5, 2016 2:38 PM UTC

Editor's Picks

- Market Data

Most Popular