The drivers of the dollar’s expected medium-term grind weaker in the refreshed forecasts are largely the same ones as we originally outlined in our recent post although the trade-weighted dollar Index has gone up by 0.2% and is up 1.7% since mid-Feb. The late-cycle growth and rate hikes in the US economy providing diminished support for the dollar, against early-cycle policy normalization in most of the rest of G10, and stronger synchronized global growth supporting the high-beta blocs of EM and commodity FX.

More and earlier dollar weakness in our forecast revisions simply reflects these forces coming into play sooner and more forcefully than originally expected, given various upgrades to global growth and policy normalization expectations that our economics colleagues have introduced to-date.

Nevertheless, it is notable that further dollar weakness is expected in spite of another material upgrade to US growth forecasts, following a likely second round of fiscal stimulus being delivered by Washington budget negotiations.

It rallied on the back of the Fed’s lead in the monetary policy cycle. Not only is the rest of the world slowly catching up, but it seems increasingly clear that the Fed will remain extraordinarily cautious in its policy moves. We expect the Fed Funds target to peak at 2.00-2.25%, which is consistent with real 10y yields peaking not far from current levels (52bp) and well below the 72bp we saw in December 2016. That’s not negative for the dollar but means that the currency is vulnerable both to its high valuation and to improving FX fundamentals of other major currencies, including but not limited to the euro.

EM currencies rely more on carry for returns. But valuations aren’t yet demanding and the growth backdrop offsets gradual Fed rate hikes.

While President Trump signed the proclamation on adjusting import tariffs by 25% on steel imports and 10% tariffs on aluminum imports on Thursday 8 March. Mexico and Canada have been exempted indefinitely for now, but conditional on a new NAFTA agreement. The proclamation also includes a potential for US entities to apply for an exemption. We think this could include the US oil and gas industry.

Judged by a limited historical sample, bilateral trade conflicts have tended to strengthen alternative reserve assets such as the euro, yen, and gold against the dollar.

They also tend to be growth negative for emerging markets that thrive on global trade, especially if retaliatory tariffs are involved. Despite these risks, high beta currencies have so far shown impressive resilience as investors have been reluctant to turn overly bearish given above-trend global growth. The lack of many reactions from the likes of AUD, NZD, and CAD opens up opportunities to buy under-priced option hedges.

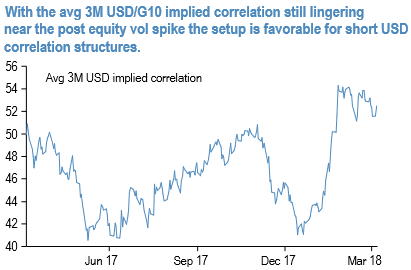

Most notably, aggregate USD-denominated implied correlations still trade near their highs from around the VIX shock (refer above chart) – a set-up that is favorable for betting on the divergence between reserve and high beta currencies via short USD correlation structures. In the recent past, we already initiated a tilt towards correlation selling via triangles of short USDJPY and NZDUSD puts hedged with long NZDJPY puts.

Currency Strength Index: FxWirePro's hourly USD spot index was at shy above 6 (which is neutral) while articulating (at 09:32 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential