Technical glimpse: AUD/USD hasn't been able to to break resistance at 0.7650 levels quite often in recent times (see weekly charts for inability to take the rallies above 0.7650 from last 2-3 weeks).

As a result, last week we've seen the price drops to slip below 7DMA.

OTC updates:

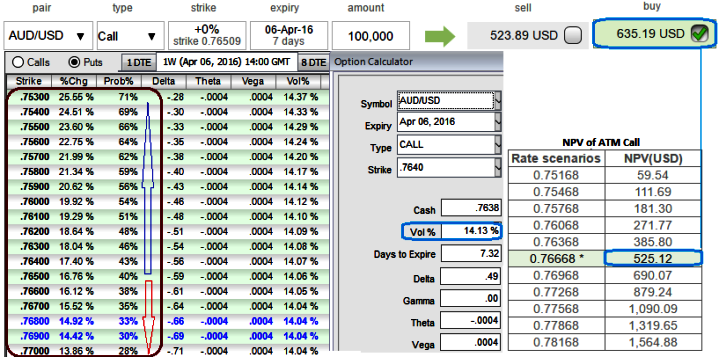

1W ATM IVs of AUD/USD is the highest among G10 currency space (more than 14%).

The premiums on ATM calls are trading 20.95% more than Net Present Value of the contracts. While, risk reversals are still indicating bearish risks.

Option Strategy: 3-Way diagonal options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Contemplating above mentioned technical reasoning, and the disparity between ATM implied volatilities of 1W expiries and call option premiums, we reckon the shorts on slight OTM strikes of call would benefit straddle strategy.

Most importantly, let's have glance on OTM strikes and their relevant %change in premiums & %probabilities of expiring these strikes in the money that keeps us eye on shorting expensive calls with shorter expiries in conjunction with ATM straddles.

As a result, we capitalize on such beneficial instruments during higher volatility times and deploy in our strategy.

How to execute:

Go long in AUDUSD 1W at the money -0.49 delta put, go long 1M at the money +0.50 delta call and simultaneously, Short 1W (1%) out of the money call with positive theta or closer to zero.

Margin: Yes, required to short OTM calls.

Description: Trade the expectation of increased volatility without taking a view on direction but slightly bearish bias.

A strategy usually utilized over significant economic data events and other political events.

Return: The profitability increases as the underlying spot FX of AUDUSD rises but to the extent of OTM strike price and it would be unlimited returns on slumps.

Risk: Underlying pair should not exceed OTM strike within maturity chosen on writing call option.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Note: Extra bit of advantage comes through shorting on OTM call that finances the total cost of trade but be mindful of OTM strikes.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields