Bearish EURAUD scenarios:

1) ECB delays hiking until 2H’19 as growth struggles and core inflation is capped at 1%.

2) Faster US corporate repatriation.

3) China eases policy and commodities rebound

4) The RBA adopts a hawkish tone abruptly to its communications.

Bullish EURAUD scenarios:

1) Euro area growth rebounds to 2.5-3% by mid-2018.

2) ECB becomes more comfortable with progress on wages and core inflation.

3) The Aussie unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market.

4) China data weaken materially and the risk markets retrace and vol rise

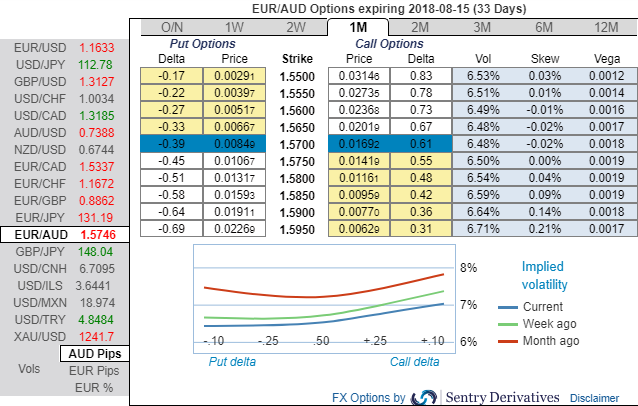

Most importantly, please be noted that IV skews of EURAUD are stretched on either side, but the positively skewed IVs of 1m tenors are signifying more hedging interests in the bullish risks. The bids for OTM puts of this tenor indicate that the underlying spot FX likely to slide upto 1.5950 levels so that OTM calls would expire in-the-money.

Contemplating above OTC hedging setup, it is sensed that all chances of the Aussie dollar may look superior over Euro in medium-term future, we advise hedging the Euro’s depreciation over AUD through below recommendations.

We’ve been firm to hold on this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2w At-The-Money delta call option and simultaneously short 2 lots of 15D At-The-Money put options of similar expiries.

It involves buying a number of ATM calls and double the number of puts. The strip is more of customized version combination and more bearish version of the common straddle.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Hence, any hedger or trader who believes the underlying currency is more likely to plunge downside can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 15 (which is neutral), while AUD is flashing at -36 (bearish), while articulating at 09:05 GMT.

For more details on the index, please refer below weblink:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis