Before we proceed further, please go through below weblink where we’ve stated the potential bearish pressure as a result of head and shoulder candlestick charting pattern which is bearish in nature.

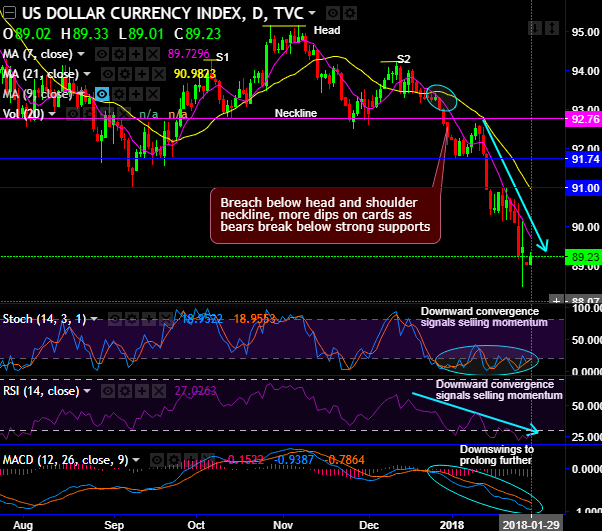

Well, please glance at daily plotting of the DXY chart, we trace out mounting bearish pressures ever since the bears have managed to break below the neckline of head and shoulder pattern.

Both leading (RSI and stochastic curves) & lagging (MACD and DMAs) indicators are substantiating this bearish stance. Subsequently, the bears are now on the verge of extending 3-years lows.

Although the dollar index slightly spiked today (DXY at 89.11), however, the current prices have remained well below 7 & 21 DMAs, its slide on Friday to counter Thursday’s rally was major owing to the commentaries from Donald Trump.

The DXY remains centered around the 89.00 area with gravity still expected to remain a threat to the index. Note however that potential trade tensions may also continue to lurk near the surface, with US President Trump highlighting “very unfair” EU trade policies over the weekend. With skepticism towards the dollar still significant at this juncture, investors may continue to disregard underlying dollar support stemming from rate differentials.

Coupled with palpable anxiety around the longevity of the unusually swift dollar downtrend, while contemplating above driving forces, we have already advocated the vol structure is motivating considerations of short front vs long back USD put calendar spreads as theta harvesting overlays on dollar shorts.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -11 (which is neutral) while articulating at 10:22 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings