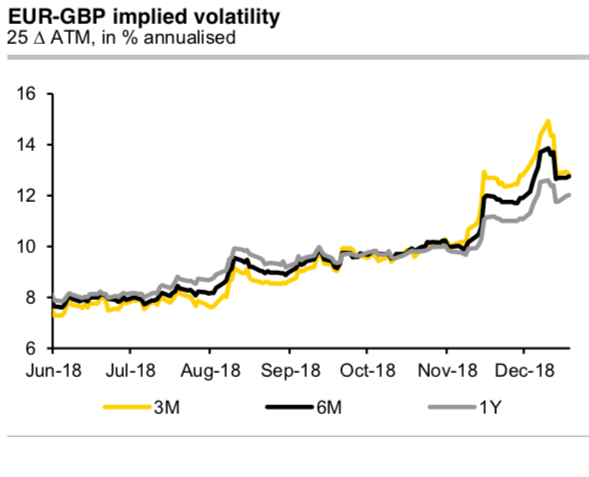

In our recent post, we emphasized on the fall in sterling volatilities on the options markets (referring to 1st chart) does not really make total sense to me. Has the uncertainty concerning Brexit really fallen in the eyes of the market since the vote in the House of Commons was postponed? Of course, it was clear that Prime Minister Theresa May would lose the vote on her withdrawal agreement. the quieter sentiment on the markets has got one major advantage. For all those who may not have hedged their GBP risks yet, the current situation provides a reasonably attractive entry level.

In this write-up, we nowelaborate a RV implementation in the FX Vol space that efficiently facilitates tactical VIX fading over the next few weeks. The past few weeks were characterized by tension on Equity markets, which nonetheless on average failed to propagate materially to the FX space (including EM), exhibiting a similar behaviour to the one from February. Still, with a VIX at 21, having reached a post-February maximum of 25 two months ago, it is tempting to consider opportunities in the FX vol space for playing a further decline in the VIX (it remains 75% higher than the early October levels).

As the JPM’s equity derivatives team forecasts a decline of US Equity vol from current elevated levels, several factors also point to a short-term relief in market stress, amongst which increased expectations of a short- term easing in US/China trade tensions, more conciliatory tones in the Italy-EU dialogue regarding fiscal budget, and Theresa May’s confidence vote win earlier this week that possibly reduces the chances of a hard-Brexit.

While the structural factors supporting our strategic view that FX Vols are poised to rise over 2019 remain intact, the recent softening in the Fed stance is lending a helpful hand in relieving the recent downbeat sentiment pressures. With the holidays just around the corner, FX vol (VXY-GL down almost 0.5pts since the early Dec high) is on track to get a breather.

2nd chart displays the VIX-beta for DM FX vols (against the USD), in a 2-dimensional regression (with data since 2005) using also the VXY vol index as a regressor.

Based on the chart, we note that AUD is the G10 FX volatility showing the highest sensitivity to the VIX, a specific which clearly manifested itself in early December. Investors interested in participating in a calmer year-end could consider tactically selling AUD vol for playing a lower VIX level over the next few weeks. Based on the same analysis, NOK vol is one of the least exposed to moves in the VIX.

Given the sensitivity of the currency to Oil prices, in the bottom chart (zooming on 2018 data) we compare USDNOK implied vol with two fair value regressions, one using the two factors described above, one incorporating Oil volatility as a third regressor. NOK volatility is undervalued in both (2- and 3-factor) regressions by around 1vol, having failed to react to a sharp rise in Oil volatility (to which it is positively exposed) in early November. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -50 levels (which is bearish), while articulating at (13:16 GMT).

For more details on the index, please refer below weblink:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch