Gold -

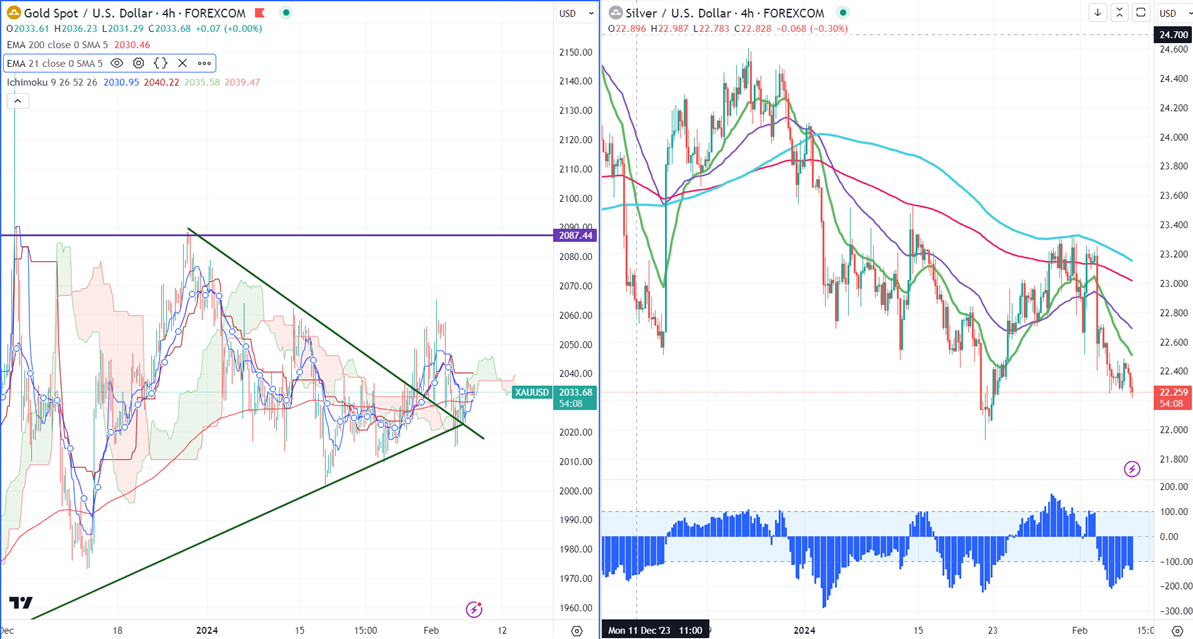

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2030.95

Kijun-Sen- $2040.22

Gold pared some of its gains after hawkish comments from Fed members. Fed member Loretta Mester said that the central bank would lower rates "later this year". "It would be a mistake to move rates down too soon or too quickly without sufficient evidence that inflation is on a sustainable and timely path back to 2%. The yellow metal hit a low of $2031.38 at the time of writing and is currently trading around $2031.36.

According to the CME Fed watch tool, the probability of a no-rate cut in Mar increased to 78.50% from 58.80% a week ago.

US dollar index- Bullish. Minor support around 103.50/102.75. The near-term resistance is 104.60/106.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2030, a break below targets of $2015/$2000/$1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2060/$2070/$2080/$2100.

It is good to buy on dips around $2000 with SL around $1970 for TP of $2065/$2080.

.

Silver-

Silver broke significant support at $22.24 (200-WEMA) and hovers around that level. It trades below 21 and 55- EMA in the weekly chart. Any weekly close below $22.23 confirms major bearishness, a dip to $20.68 is possible. The near-term resistance is around $22.50 and a break above confirms an intraday bullishness. A jump to $22.75/ $23/$23.35 is possible.

Crude oil-

WTI crude oil prices recovered slightly after EIA revised US production data. US oil output will expand by 160000 bbls per day from 1.02 million bpd.

Major resistance- $75/$78. Significant support- $70/$68.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics