Gold -

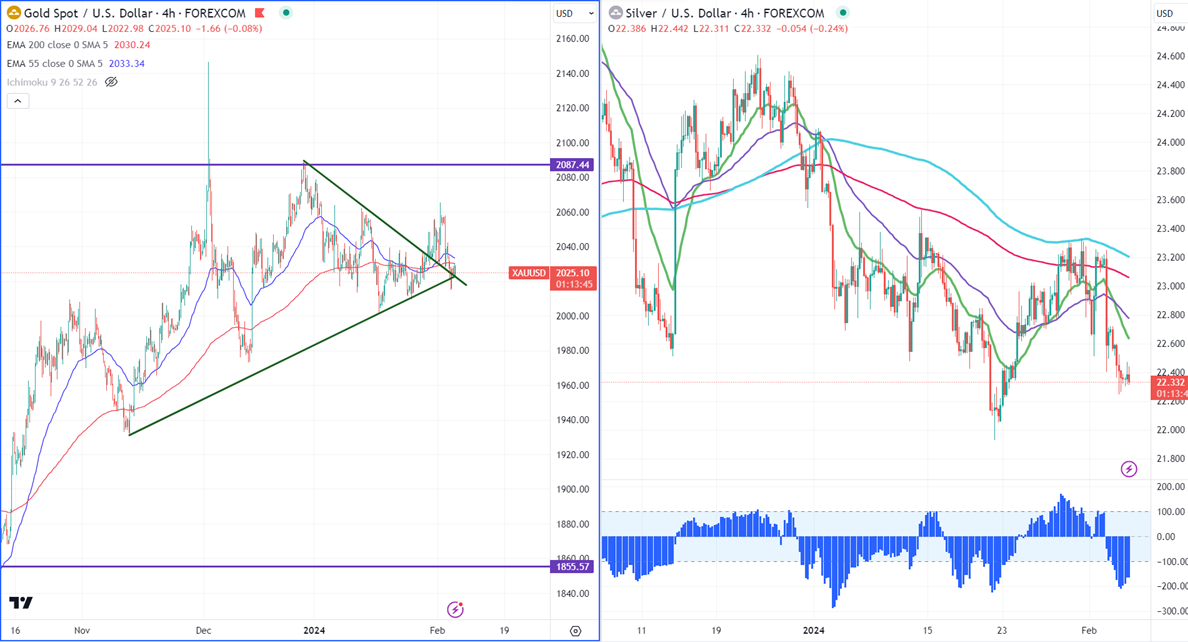

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2028.65

Kijun-Sen- $2040.22

Gold traded flat after a sell-off of more than $50. The yellow metal was one of the worst performers in the past three days due to upbeat US economic data. US services PMI came at 53.4 in Jan, above the forecast of 52. Powell's hawkish comment in a CBS interview, "We just want some more confidence before we take that very important step of beginning to cut interest rates, "might decrease chance the of an early rate cut by the Fed. The yellow metal hit a low of $2014.97 yesterday and is currently trading around $2023.90.

According to the CME Fed watch tool, the probability of a no-rate cut in Mar increased to 83.5% from 52.9% a week ago.

US dollar index- Bullish. Minor support around 103.50/102.75. The near-term resistance is 104.60/106.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2015, a break below targets of $2000/$1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2060/$2070/$2080/$2100.

It is good to buy on dips around $2000 with SL around $1970 for TP of $2065/$2080.

.

Silver-

Silver broke significant support at $22.40 and holds below that level due to the strong US dollar. It trades below 21 and 55- EMA and long-term MA (200- EMA) in the 4-hour chart. The near-term resistance is around $22.50 and a break above confirms an intraday bullishness. A jump to $22.75/ $23/$23.35 is possible. It is immediate support at around $22.20. Any break below target $21.90/$21.50.

Crude oil-

WTI crude oil prices trading flat as US Secretary of State Antony Blinkento discusses ceasefire.

Major resistance- $75/$78. Significant support- $70/$68.

Feb 6th, 2024, Canada Ivey PMI (3:00 pm GMT)

Fed Member Mester speaks (5 pm GMT)

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed