Bearish CADJPY Scenarios:

1) NAFTA withdrawal;

2) The US falls into recession and spills over globally;

3) BoC as aggressively as the Fed, rewidening rate spreads beyond 65bps

4) The trade tensions between the US and China intensify and global investors’ risk aversion heightens significantly

5) Unexpected monetary policy change by the BoJ

6) The US starts vehemently criticizing Japan’s trade surplus with the US.

Bullish CADJPY Scenarios:

1) Fed cuts more aggressively than expected;

2) BoC does not follow the Fed and holds rates indefinitely;

3) Ratification of USMCA and end to US-China trade conflict

4) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens.

CADJPY has slid from the highs of 91.637 to the recent lows of 78.502 levels, currently trading at 81.057 levels, the major trend is likely to extend downswings up to 79 levels.

OTC Updates and Options Strategy:

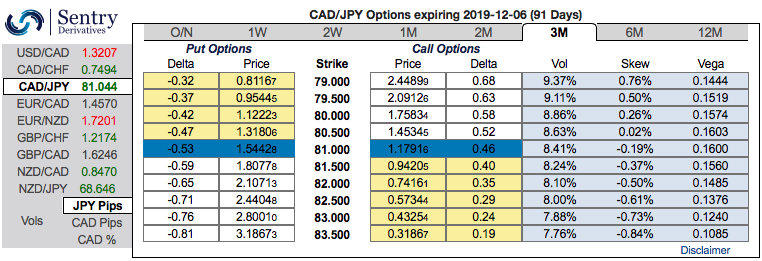

The positively skewed CADJPY IVs of 3m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 79.000 levels indicating downside risks in the medium terms (refer above chart). Please also observe the above technical chart for the major downtrend. Accordingly, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of similar tenors. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of the customized version of options combination and more bearish version of the common straddle.

Huge profits achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move.

Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short-run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

Alternatively, contemplating above technical rationale, it is advisable shorting futures contracts of mid-month tenors on hedging grounds, as the underlying spot FX likely to target southwards 79 levels in the medium terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix & JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch