The escalation of US-China trade tensions has been a key driving force for the commodity market turbulence, and the shrinking volatility in the metals complex. As global trade tensions heat up, the potential impact could be two-fold.

On one side, our forecast of above trend global growth is being increasingly challenged as an escalation in global trade tensions will bring with it significant supply shock to the world economy, raising inflation and lowering growth.

The indirect effect of trade wars is the loss of confidence, resulting in corporate and household retrenchment that eventually leads to generalized tightening in financial conditions; we particularly see the start window for an intermediate Precious Metals rally open.

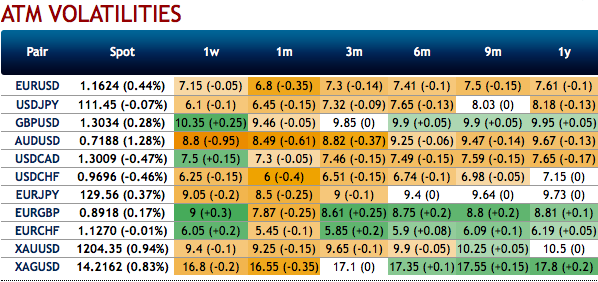

Please be noted that the 1m IV skews of XAUUSD (gold options) have been well balanced on either side and signify the hedgers’ interests on both OTM call and put strikes. While the combination of 1m bearish neutral remains intact with shrinking IVs are conducive for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

While it is reckoned that as per the OTC indications as shown above and the prevailing trend in bullion markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot gold prices on check. On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on downside and with cost effectiveness.

While the risk-averse traders who are dubious about upside move, accordingly, initiate longs in XAUUSD 1M at the money -0.49 delta put, and go long 1M at the money +0.51 delta call and simultaneously, Short 2w (1%) out of the money calls. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -68 levels (which is bearish), while articulating at (12:55 GMT). For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data