Amid various central banks’ monetary policy season, this week include the US FOMC, Bank of England, Bank of Japan and Swiss National Bank.

Most attention is likely to be on the FOMC, which is most likely to leave policy rates on hold, with Chair Yellen set to communicate on the risks to the economic and policy outlook.

The Fed meets this week (June 14/15) but that is unlikely to be the focus with Brexit looming.

OTC updates:

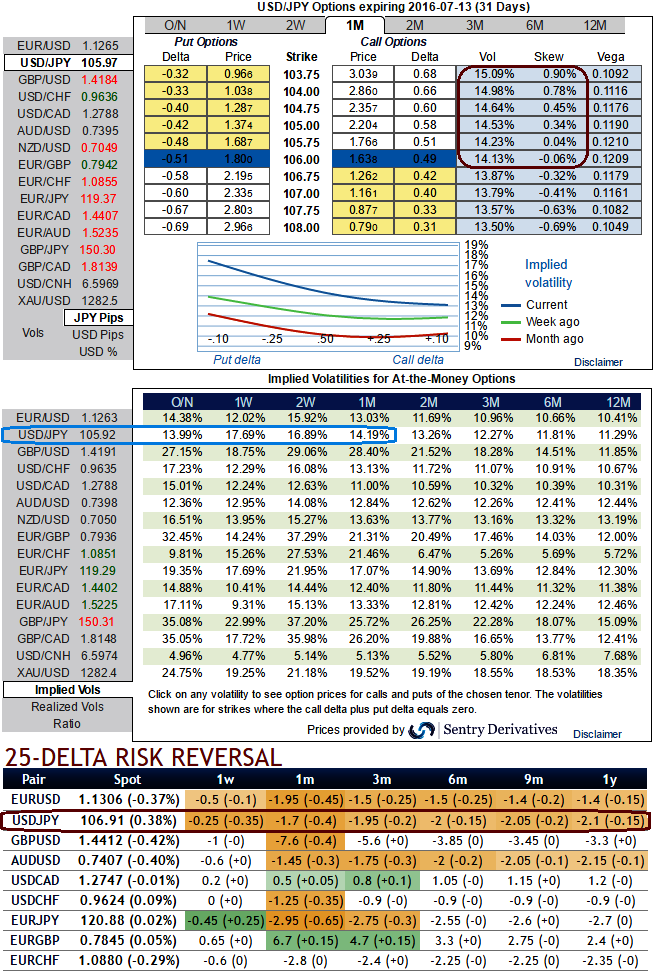

As you can probably observe, options of OTM put strikes evidence higher skews with higher vols.

The current ATM IVs are trending above at 17.69% ahead of above mentioned central banks events.

While delta risk reversal of this pair signals more bearish pressures in long run by flashing negative RR numbers.

Why do we think USDJPY sensing pressures for downside risks: The delta risk reversals evidence the difference in volatility on various strikes, and therefore the price difference between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Since these FX options risk reversals take volatility analysis one step further, practise them not to predict market conditions but as a gauge of sentiments on a specific currency pair.

That is why while formulating hedging strategy, in FX options weekly forecasts, we use RR to gauge trends and shifts in trends for major currency pairs.

Yet we have found it is a bit more difficult to use the absolute Risk Reversal number in creating set strategies, as different dynamics across currency pairs complicates standardization of strategy rules.

Although the Fed will likely to remain on the sidelines on March 16th, the improving domestic backdrop supports our view that the Fed will continue on with its gradual tightening cycle in June.

We think current macro situations lead the fed to almost defer policy actions to June meeting, but manipulative statements on monetary policy outcome may keep USDJPY at stake.

On the other hand, we can very much empathize with this Yen against the dollar to gain slightly at least in the short run (let's say next 2 months or so) with an anticipation of Fed may continue to hold on its rate stance until Q1'16 considering global economic slowdown.

Since implied volatility is inching higher when risk reversals are higher comparatively to 1M expiries that is a good scenario for option holders in next 1-3 months, go long in 2 lots of ATM and OTM put with longer expiry (per say 2M expiries) and simultaneously short ITM puts of shorter expiries (preferably 1W tenors) with positive theta values.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch