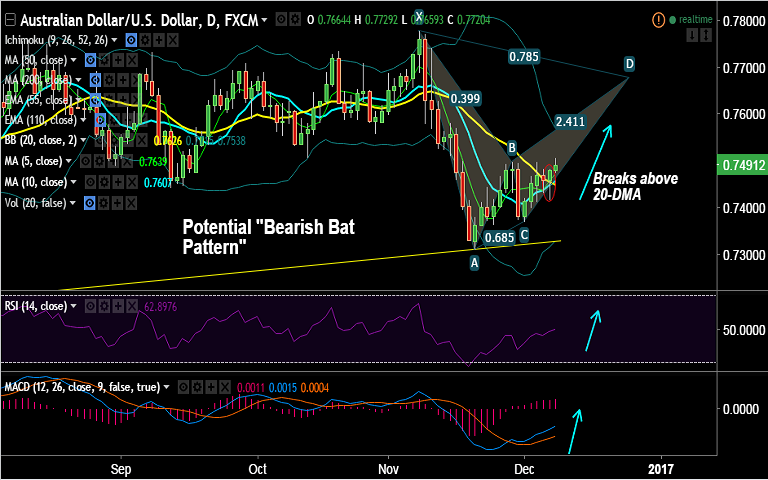

- AUD/USD has shown a breakout above 20-DMA resistance at 0.7455 on Wednesday's trade.

- Aussie shrugs off dismal Q3 GDP and weak trade deficit data and extends higher.

- The pair hit a three-week high of 0.7509 after China's trade data showed imports rose much higher than expected.

- Data released by China’s customs bureau earlier today showed Chinese imports rose 13.00% y/y in Yuan terms, which is far better than the expected rise of 3.6%.

- Stochs and MACD are biased for further gains. We see weakness only on break below 0.7325 (major trendline support).

- Support levels - 0.7472 (5-DMA), 0.7456 (10-DMA), 0.7449 (20-DMA), 0.74

- Resistance levels - 0.75, 0.7530 (200-DMA), 0.7544 (50% Fib), 0.76 (61.8% Fib)

- Our previous call (http://www.econotimes.com/FxWirePro-Possible-Bearish-Bat-pattern-on-AUD-USD-good-to-go-long-on-dips-435329) has hit TP1.

Recommendation: Bias higher. Hold for further upside. Bearish invalidation only below 20-DMA at 0.7450.

FxWirePro's Hourly AUD Spot Index was at 28.0234 (Neutral), while Hourly USD Spot Index was at -42.6605 (Neutral) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex