The USD retained its firmer tone as expectations of a December Fed hike and greater confidence in a Clinton victory continued to lend support

The US dollar index surged to a seven-month high overnight. As a safe-haven instrument, it has benefitted from concerns regarding the US elections and Brexit, as well as the looming Fed hike.

While further gains to around 0.77 are possible during the month ahead, driven in part by the faltering US dollar and yield-chasing flows, the AUD is losing energy (perhaps a reflection of its declining yield advantage). By year end, there’s a case for a correction towards 0.74 if the Fed tightens in December as we expect. (13 Sep).

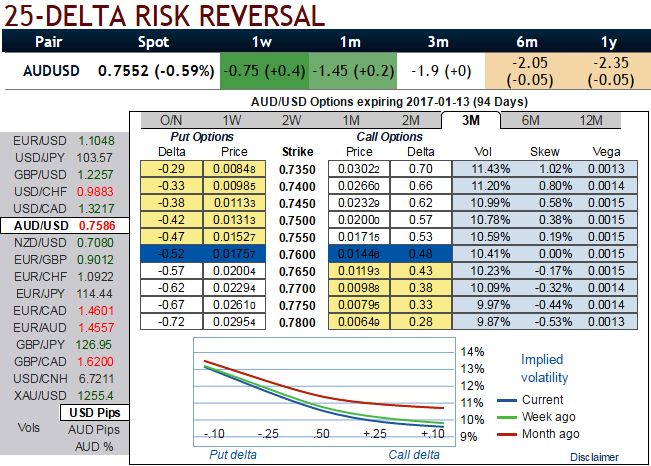

Please be noted that the implied volatility for near month at the money contracts of this APAC pair has been dropped below 10% for 1m expiry.

While 6m delta risk reversal reveals divulge more interests in hedging activities for downside risks.

We still think AUD/USD has scope to decline through to mid-2017. The currency looks elevated relative to interest rate differentials, and we don’t believe there is a much near-term upside to commodity prices from here. Still, we continue to be surprised by the resilience in the currency, and we forecast AUD/USD will reach USD0.74 by end-2016 and USD0.68 by Sep-17.

As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.7533 technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 3m skews in implied volatilities and 6m risks reversals.

The OTC options market appeared to be more balanced on the direction for the pair over the 3m to 1y time horizon and as a result delta risk reversal for AUDUSD has been maintaining negative which means puts are in higher demand and overpriced comparatively.

Capitalizing on lower IVs we eye on shorting at the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favour longs in puts in lengthier tenors.

Well, here goes the strategy, go short in 1m OTM calls and simultaneously, 3 lots of 3m puts (+1% ITM, ATM and +1% OTM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

Moreover, the strategy could be counterproductive as the skews in 3m IVs favours OTM puts strikes.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts