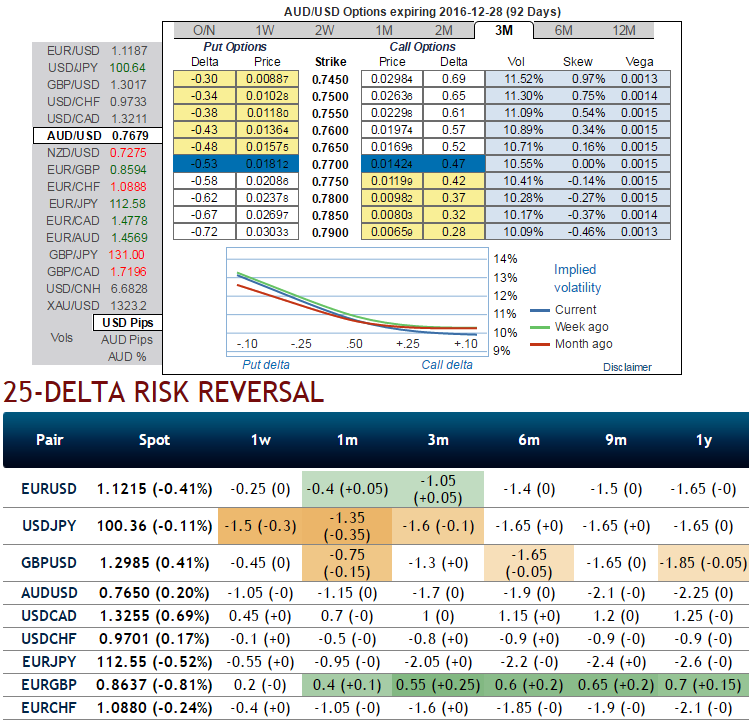

Please be noted that the skewness in implied volatility of 3m tenors of this pair signifies the hedgers interest in OTM put strikes.

While delta risk reversals of the similar expiries reveal more sentiments in hedging activities for downside risks. This would raise a cause of concern that in this phase of time, the major economic events are likely to intensify volatility in FX markets.

Hence, we could foresee AUDUSD’s direction below 0.72 in the months to come, given:

(1) The RBA easing cycle becomes more aggressive, as domestic growth slips;

(2) China growth forecasts are cut materially, or the pace of slowing accelerates; or

(3) The carry trade unwinds in response to a rise in G3 bond yields.

(4) A retracement in commodity prices should cap AUDUSD.

(5) Hopes on Fed’s rate hike during December.

Monetary policy drivers take a back seat for AUD in coming months. With the RBA now on hold for the remainder of 2016 (having cut rates by 50bp in Q2/Q3 in response to an inflation shock).

The Fed likely to be on hold until late in Q4 once money market reforms and the Presidential election are out of the way, it is hard to argue that monetary policy expectations will have much of an effect on AUDUSD in coming months.

Indeed, the recent compression in front end rate differentials as the RBA has cut rates has had little impact on AUDUSD of late, suggesting that the level of front end rates – and expectations about the path of front end rates – have had less influence on AUD than historical experience would suggest.

Contemplating the above fundamental as well as OTC factors, we construct strategy comprising of both calls as well as puts in the ratio of 3:1 so as to suit the swings on either directions.

Capitalizing on lower IVs we eye on shorting at the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favour longs in puts in lengthier tenors.

Well, here goes the strategy, go short in 1m OTM calls and simultaneously, 3 lots of 3m puts (+1% ITM, ATM and +1% OTM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

Moreover, the strategy could be counterproductive as the skews in 3m IVs favours OTM puts strikes.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom