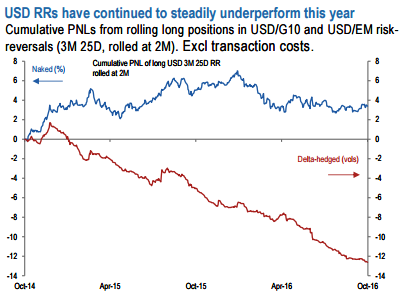

The direct corollary of this softness in vols at higher USD index risk-reversals is the continuation of USD skew underperformance.

The climb of USDCNH to its historical highs is a perfect illustration of this dynamic since 2014:

USD strengthening vs high beta currencies has tended to happen in a low vol regime, outside a few isolated exceptions (for instance: Aug 2015 CNY devaluation, Q4 2014 Oil collapse and impact on RUB, and recently Aug-Sep MXN sell-off on US Election risk), and selling USD skews has been a consistent alpha generation strategy over the past two years.

For investors looking to participate in further USD strengthening while fading rich skews, we suggest 1x2 USD call spreads for the leverage and positive carry they offer.

We rank 6M 1x2 ratio USD call spreads with long strikes ATMS and short strikes solved for 50bp premia, where it clear that the most comfortably wide breakeven ranges are achieved by USD/Asia pairs, notably USDTWD (strikes 31.62 x 33.0, breakeven at 34.36 and returning max payout - 8:1).

The jump of Euro-area composite PMIs to 53.7 (10-month highs) on Monday should alleviate downside pressure on EURUSD, as this is poised to give the ECB second thoughts about QE extension in December.

With the USD index having closed most of its undervaluation gap relative to high-frequency drivers and following a foray of EURUSD into the low 1.09s – which pushed USDPLN close to the recent highs just a touch below 4.0, we find it compelling to sell USDPLN skews.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays