The recent past has seen some notable spot gyrations our view is that FX vols are priced fairly for such backdrop and absent a major adverse development suggest keeping a status quo as our tactical gamma trading models continue to signal no place for panic and see the broad FX risk sentiment still supportive.

Equity cues remain on the front foot, supporting general risk sentiment, while the USD remains in a choppy correction phase after July’s 5% fall (RUB, MYR, NOK and KRW out-performing this month, while CLP, TRY, BRL and ZAR under-perform).

EURUSD projections are further raised, as it is reckoned that the depreciation trend of the US dollar is not yet over. It is becoming increasingly apparent that the Fed will stick to an ultra-expansionary monetary policy for much longer than was the case after past crises by which it is more and more resembling the ECB.

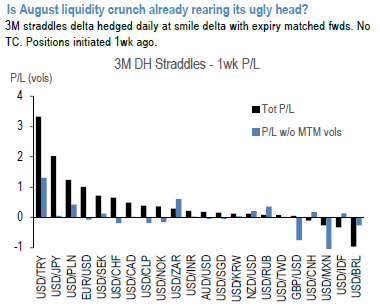

Summer liquidity can provide fertile ground for vol shocks. Prompted by low liquidity and by the sentiment taking leg lower last week, yen ripped through stop losses and has strengthened by nearly two big figures in matters of days. This week turn for EUR, EUR proxies and EMs for outsized spot moves. P/Ls from 3M delta-hedged straddles that are held for a week suggests that 80% of the USD/G10 & EM made money (refer 1st chart). But the looks can be deceiving. Stripping away the implied MTM component shows that realized vol notably performed for only 1/3ed of the currencies. The 80% count more closely reflects the market concerns rather than the actual events. That's not so surprising. After all the August liquidity crunch is real and the strong August seasonality as reflected e.g. in historical month start to month end changes in VXYGL tends to show August to be the month exhibiting vol bounce 75% of time during last two decades. Again, the details uncover a less dire backdrop. Those vol bounces have been historically vol supportive but modest in magnitude (2nd chart exhibits the distribution of vol changes is fairly tight). While the last two weeks have certainly seen some notable spot gyrations our view is that FX vols are priced fairly for such backdrop and suggest keeping a status quo absent a major adverse development. The modestly short vol leaning portfolio has seen some drawdowns particularly on the yen vol ratio spread trade amid MTM on the wider riskies which was partially offset by our defensive CNH fwd vol position. For now, we remain skeptical that the spot will genuinely deliver on yen skew. Amid the marginally more cautious backdrop below we review some limited downside and RV opportunities. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate