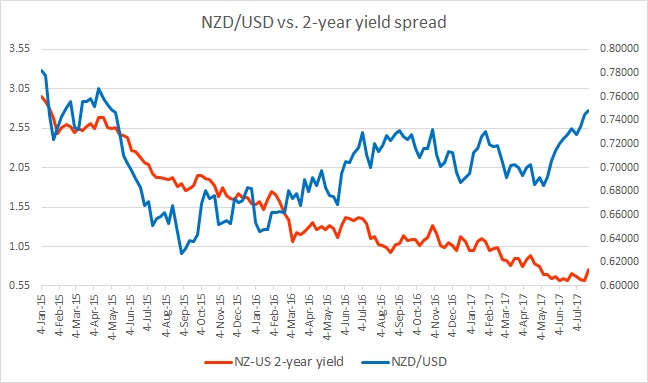

The chart above shows, how the relationship between NZD/USD and 2-year yield divergence has unfolded since 2015.

- The close relations between the short-term yield spread and the exchange rate is quite visible also the big divergence with it.

- While the Reserve Bank of New Zealand (RBNZ) reduced rates after the financial crisis of 2008/09, it somewhat increased interest rates due to higher commodity prices and higher inflows from other western economies. It raised rates by 50 basis points to 3 percent in 2010, only to reduce it again to 2.5 percent in early 2011. In 2014, it increased rates by 1 percent to 3.5 percent and started reducing rates again beginning June 2015. The rates steadily declined from 3.5 percent to 1.75 percent by November 2016, when it signaled a halt.

- It can be seen from the chart that New Zealand dollar declined from 0.78 against the dollar in January 2015 to 0.62 by August, while the yield spread declined from 296 basis points to 192 basis points.

- However, there has been divergence since then. Between now and the August 2015, the RBNZ reduced rates further by 100 basis points, while Fed raised rates by 100 basis points. The yield spread also declined from 190 basis points to just 76 basis points. However, the NZD/USD didn’t make further low, instead, it has moved higher from 0.628 in August 2015 to 0.75 as of today. The divergence is very high, as of now.

- We believe, that expectations of a rebound in commodities as well as New Zealand economy are playing parts here. However, sooner or letter the du0 would have to converge, which we expect would come in terms of rate hikes from RBNZ and increase in the spread in favor of the New Zealand dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022