Euro Zone sentiment report showed confidence tilted despite additional stimulus from European Central Bank. Moreover the data were collected before recent terror attack on Brussels.

- Economic slowdown and fear among business leaders that monetary policy reaching its limit likely to be major driver behind ebbing optimism.

- However concerns over immediate hard landing in China is less of a concern now.

- The potential British exit from the Union, id what some business leaders likely to be worrying about. Lot of investment projects are on hold.

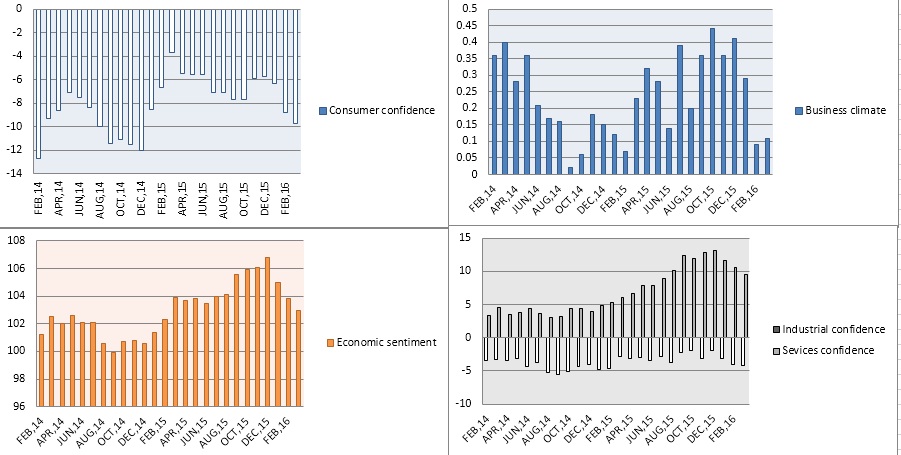

Today’s economic survey showed that sentiment across Euro zone dropped.

- Euro zone business climate is the only indicator that improved but marginally to 0.11. Still around levels last seen back in February last year.

- Industrial confidence dropped to -4.2 lowest since February, 2015. Economic sentiment soured to 103 worst reading since February, 2015.

- Services sentiment dropped drastically to 9.6, lowest reading since July, 2015.

- Consumer confidence dropped to -9.7, worst reading since December, 2014.

All in all trend suggests, that Euro Zone confidence picked in December last year and haven’t really recovered after ECB disappointment and Market turmoil at start of the year.

Euro broadly ignored the release and gaining over weaker Dollar, currently trading at 1.131 against Dollar.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains