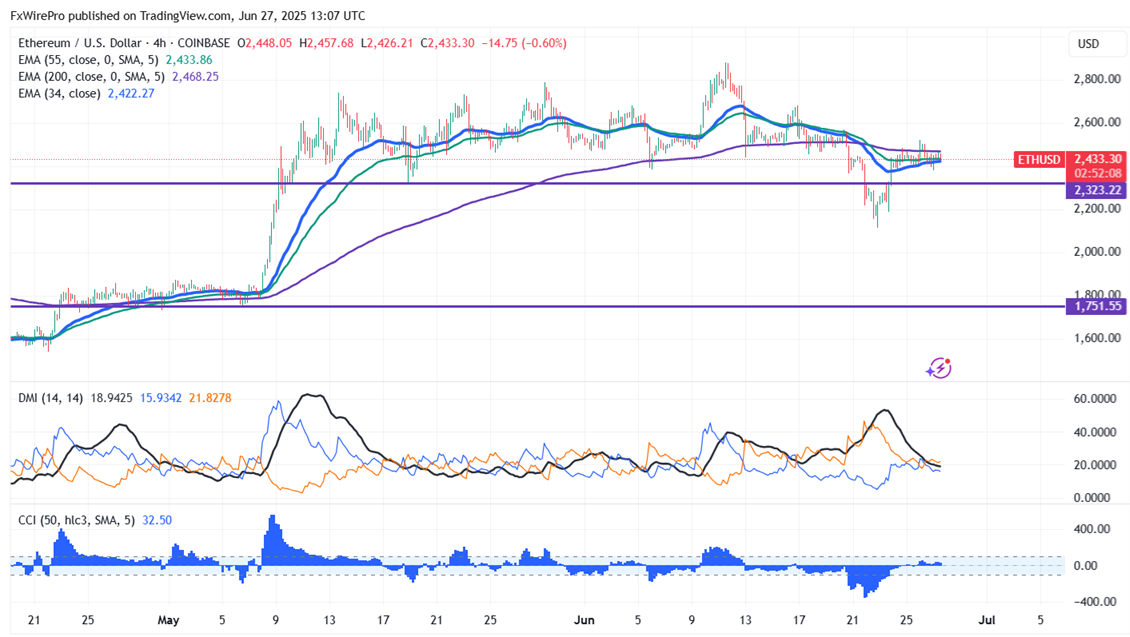

ETHUSD is consoliating in a narrow range after a minor pullback. It hits an intraday low of $2381 and is currently trading around $2432.

Despite ongoing market volatility and a brief episode of outflows, U.S. Ethereum spot ETFs managed to attract approximately $232 million in net inflows over the past week. This marks the ninth consecutive week of positive flows, with cumulative inflows reaching $2.2 billion in just the last six weeks. Notably, BlackRock’s ETHA ETF registered its first daily outflow on June 21st. However, this was largely counterbalanced by continued inflows into other funds such as Grayscale’s ETHE and VanEck’s ETHV. These trends indicate sustained investor interest and a propensity for portfolio repositioning in response to price fluctuations.

Overall trend remains bullish as long as support $2000 remains intact. Watch out for $2500, any break above targets $2600/$2661/$2715/$2770/$2880/$3000/$3400/$3600/$3800/$4000. A robust bullish trend will only materialize above $4100.

Immediate support is around $2300. Any violation below will drag the price down to $2000/$1750/$1675/$1620/$1500/$1200/$1000. A breach below $1000 could see Ethereum plummet to $800/$500.

It is good to buy on dips around $2300 with SL around $2000 for a TP of $3000/$4000.