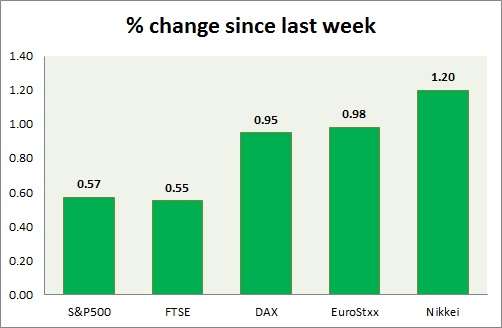

Equities are broadly in green today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is closed over Labour Day holiday.

- S&P 500 future is currently trading at 1934. Immediate support lies at 1900 and resistance 2000.

FTSE -

- FTSE is up today, amid low volume due to New York closing. Today's range 6040-6130.

- FTSE is currently trading at 6070. Immediate support lies at 5950 and resistance 6600.

DAX -

- DAX is up due to dovish ECB comments last week and subsiding risk aversion. Today's range 10000-10180.

- DAX is currently trading at 10100. Immediate support lies at, 9750 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is up (+0.6%), France's CAC40 is up (+0.45%), Italy's FTSE MIB is up (+0.7%), Portugal's PSI 20 is down (-0.8%), Spain's IBEX is down (-0.45%).

- EuroStxx50 is currently trading at 3200, up by +0.9% today. Support lies at 3000 and resistance at 3300.

Nikkei -

- Nikkei started the week in green, however facing headwinds of stronger Yen. Today's range 17460-18020

- Nikkei is currently trading at 17840, with support around 16000 and resistance at 19500.

|

S&P500 |

+0.57% |

|

FTSE |

+0.55% |

|

DAX |

+0.95% |

|

EuroStxx50 |

+0.98% |

|

Nikkei |

+1.20% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary