Today second estimate of US fourth quarter GDP will be released at 13:30 GMT.

After first US rate hike by FOMC, growth and employment remains key stat to watch out for to gauge further monetary policy moves. If growth slows down abruptly, FED might even consider easing policy but we are still a bit far away from such moves. As of now any weaker data would mean Fed would have to wait longer for policy moves.

Past trends

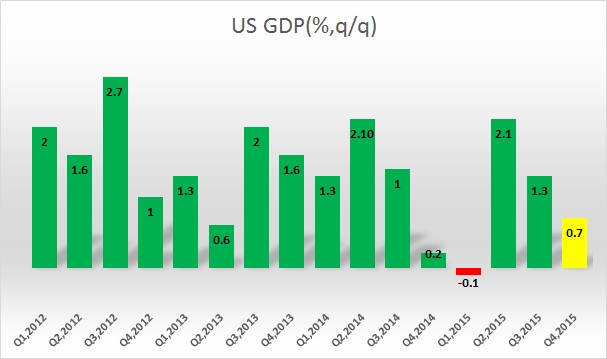

- US GDP picked up pace since 2013 and increased pace in 2014. However after rising 5% and 2.2% in previous two quarters, US GDP shrank by -0.1% in the first quarter of 2015. Historically speaking US economy usually falters in first quarter.

- Second quarter was relatively better, with GDP growing at 2.1% in second quarter from the first.

- Growth has slowed further in third quarter, with GDP growing about 1.3%.

- Flash estimates are suggesting fourth quarter would even be weaker. According to first flash estimate US economy grew 0.7% in fourth quarter.

Expectation today -

- Economists are expecting GDP to slow down further and grow only by 0.4% in final quarter of 2015.

- However data could surprise to the upside, given strong showing in employment gains and wage growth.

Market impact

- US economy is largely expected to weaken, but if the number drops in negative, it might steal away recent equity rally and Dollar might drop hard. However weaker but positive number above 0.1% may not make much of a difference

- However, if data do surprise on the positive side then it has higher potential to be a market mover. Any number above 1% would push equities higher and make Dollar stronger.

S&P 500 is currently trading at 1962, up 0.5% so far today and Dollar index is trading at 97.35, down -0.1% for the day.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed