The Reserve Bank of Australia is scheduled to announce its monetary policy decision on 4th October. It will be new Reserve Bank governor Philip Lowe's first RBA board meeting as governor. The RBA will release its second Financial Stability Review of the year on the 14th of October and the minutes of the meeting will follow on the 18th October. The new agreement between the RBA governor and Australian treasurer signed mid-Sep which changed the target of reaching 2-3 percent inflation “over the cycle” to “over time” and increased focus on financial stability will be the main point of interest.

Australian GDP is growing at a solid 3.3 percent and the unemployment rate is declining gradually. Consumption accounts for more than half of GDP and despite the recent weakness, spending is likely to pick up as house prices are growing at a solid rate and employment and wages are both higher. Housing continues to be a key driver of strength and housing activity will continue to grow into next year given a record backlog of work.

"We continue to expect the RBA to keep the cash rate on hold at the record low of 1.5%. The trajectory of the AUD also remains important to the RBA’s deliberations, as well as labour and housing market data," said ANZ in a report to clients.

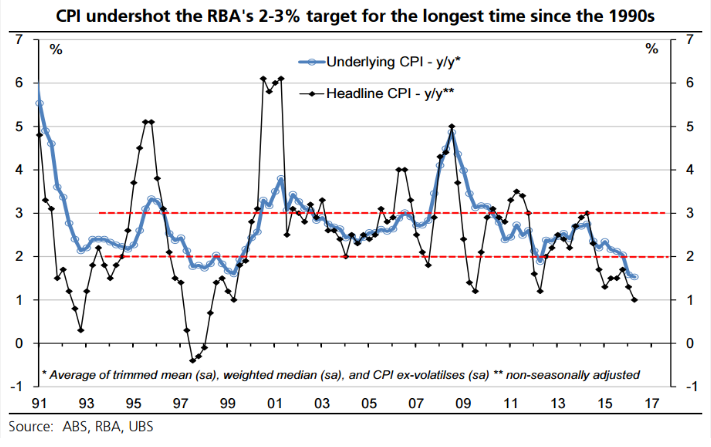

The RBA's August quarterly statement projected sustained low inflation which left the door open for yet more easing at some point. Underlying inflation still remains well below the RBA’s 2-3 percent inflation target. The RBA remains concerned about persistently low inflation, but a strong housing market looks likely to keep policy on hold. The September statement and minutes indicated little urgency to cut further.

Australian Reserve Bank governor Philip Lowe also sounded optimistic about the Australian outlook in his speech last week. Lowe believes Australia’s economy does not warrant lower rates, but he has left open the possibility that he may be forced into it by the monetary policy action of central banks elsewhere.

“If we are seeing the end of the mining investment fall and if we have got some stability in the terms of trade, I think there are reasonable prospects that we will continue to see good activity in the non-mining economy that will see a stabilisation and even a gradual pick-up in wage growth. That will feed through in time to inflation,” Lowe told the House of Representatives economics committee last week.

AUD/USD was 0.24 percent higher on the day. The pair was trading at 0.7653 at around 11:45 GMT. The pair has broken major trendline resistance at 0.7655 and we see scope for further upside. Technical indicators are biased north on the daily charts. RSI is strong at 58 levels with scope for further upside. 20-day MA at 0.7576 is major support, while immediate resistance is located at 0.7675 (Sept 22 high).

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady