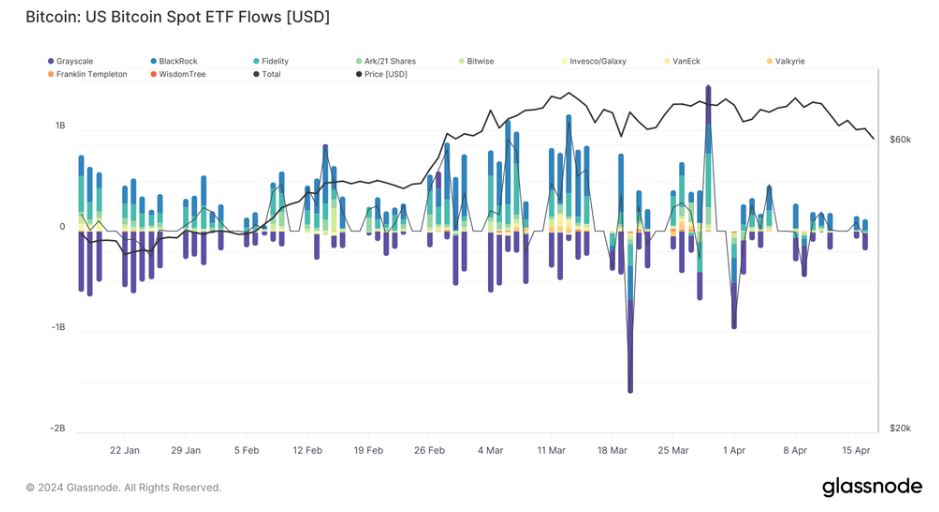

Institutional investment is changing the whole landscape and leading the charge for mass adoption of cryptocurrencies. Institutional investors refer to investment funds, pensions, private wealth management firms, corporations, banks, insurance companies, and even governments. They invest in cryptocurrency for various reasons, including diversification and hedging against weakened fiat currencies. Data by market intelligence firm Glassnode shows institutional inflows into Bitcoin Spot ETF’s.

Now, institutional investment is different from individual investors adding a few tokens to their crypto wallet. It tends to bring large capital inflows, a strategic approach, and a heavy focus on regulation and security. Eventually, it will help stabilize the market and take crypto to a new level.

Firstly, it's essential to understand what is driving this institutional switch to cryptocurrency.

Regulatory Clarity and Supportive Policies

This year has seen a series of breakthroughs regarding crypto regulation, and the new US President-elect's commitment to crypto has given institutional investors the confidence to press ahead.

The World Economic Forum, the International Monetary Fund, and a series of other international bodies have set about producing collaborative legislation with a simple set of fundamental rules. A cohesive set of regulations benefits the crypto industry and builds institutional trust.

In the United States, the new President-elect reaffirmed his commitment to creating a Bitcoin Federal Reserve and promised crypto-friendly legislation as part of his campaign. This signaled institutions to commit to a series of products like Bitcoin ETFs and investing in crypto directly.

BlackRock launched options trading on its IBIT ETF in November, and the results were spectacular, with $1.9 billion in notional exposure on the first day of trading. This success will inevitably lead to further forays into crypto and a rush of institutional investment, as old money starts to get comfortable with the asset class.

Binance CEO Richard Teng, leader of the world’s largest cryptocurrency exchange by volume, explained his views on the effects of options trading on the crypto markets, “The launch of BTC ETF options is a natural progression in the evolution of crypto markets, aligning them with the sophisticated structures that characterize traditional finance. Just as derivatives markets have historically amplified engagement in equities and commodities, a robust crypto derivatives ecosystem could significantly scale institutional adoption. With regulators and clearinghouses aligning to support these innovations, the path forward looks promising for investors seeking diverse ways to engage with digital assets.”

Real-World Blockchain Use Cases

In the beginning, Cryptocurrencies were seen as tokens for speculative trading, but the Web3 blockchain technology behind them has evolved into a real driving force for the crypto economy.

Decentralized Finance and stablecoins are two real-world use cases that have helped bridge the gap between cryptocurrencies and traditional finance. People and companies can send, borrow, and lend money without an intermediate bank. This is peer-to-peer finance, and the likes of Celo have brought basic financial services to the world's poor and unbanked, while large corporations have easily moved large amounts through DeFi.

Now, blockchain technology is deployed throughout the corporate world, and Web3 is helping to redefine supply chain management, healthcare, and other critical industries. The blockchain's smart contracts mean vast processes can be broken down and automated, people can be taken out of the loop, and businesses can become more efficient and cheaper to run. Web3 can also do a better job than Web2 in terms of privacy and user control of their data.

Now, the banks and financial institutions themselves are incorporating blockchain technology and using the tokens as a matter of course.

Web3 Superstars and the AI Era

Blockchain congestion, variable fees and other issues mean the blockchain was more of a working prototype than a viable tool. That is changing fast. Ethereum 2.0 with Layer 2 scaling solutions is much faster, cheaper, and more effective. Solana is exponentially faster and could be the future, and creators are looking to produce next-level dApps that will usurp the old giants like WhatsApp and Facebook.

With AI coming on strong, the future looks even brighter, as Web3 and AI have proven to be a near-perfect match. Now, we're looking at intelligent dApps that can control entire business processes and an ecosystem of AI agents. It's an exciting future and a much easier sell than the old technology.

Web3 is already in use at Nike, Starbucks and IBM, but it needs generational superstars - the dApps that change our world, to bring the masses to the blockchain. They are coming.

Retail Acceptance

Ferrari, Microsoft, Shopify, and PayPal all take crypto as payment for goods and services, and this is part of a broader revolution. These companies provide the social proof that local retailers and small businesses need to integrate crypto into their payment processors.

When it's easy to spend Bitcoin, more people will carry it, creating an entire ecosystem for crypto cards, advanced app-based wallets with instant pay features, and much more. Retailers have been slow to turn to crypto, but this is starting to change for the better.

Retailers need to get with the crypto program, which could be a big trend in 2025.

Wrap Up

As institutional investors continue to add to the crypto positions and favorable regulations get passed, the crypto market will reap the rewards through stability and mass adaption.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes.

Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  Investors value green labels — but not always for the right reasons

Investors value green labels — but not always for the right reasons  Investors Brace for Market Moves as Trump Begins Second Term

Investors Brace for Market Moves as Trump Begins Second Term  Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’

Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation

Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War