Bitcoin price has reclaimed $10k levels yet again, in yesterday’s session, it showed almost more than 8% rallies, currently trading above $10,100 levels.

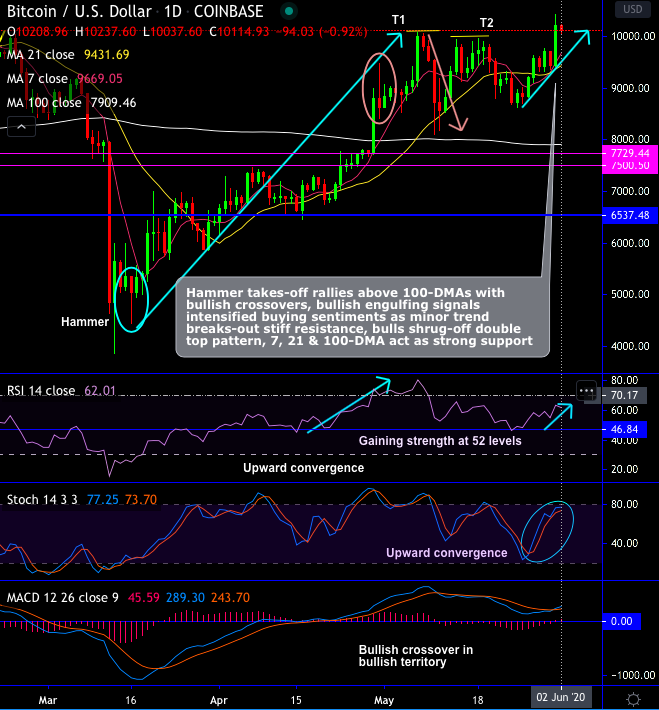

Technically, bullish engulfing pattern has occurred at $10,208 to signal the intensified buying momentum as the minor trend breaks-out stiff resistance in this bullish rout (refer 1st chart). Bulls shrug-off double top pattern, 7, 21 & 100-DMA act as strong support.

Prior to which, hammer takes-off rallies above 100-DMAs with bullish crossovers, bulls in the minor trend breakout stiff resistance amid this upward journey.

Since mid-March, BTC has spiked from $3,858 to the current $10,079 which is 160% rallies. The major trend has retraced more than 38.2% Fibonacci levels of December’2018 lows and December’2017 highs (refer 2ndchart).

Amid such volatility, as we could foresee strong support at $7,900 levels (i.e. 100-DMAs), long hedges have already been advocated using CME BTC Futures when the underlying BTC was trading at $4,927 levels, and we wish to uphold the same positions with June months deliveries. It is unwise to keep speculating on the next upside target and accumulate fresh bitcoins. Instead, one can certainly uphold the above advocated long hedges for now (spot reference: 9,526 levels).

The recent buying momentum is catalysed by BTC premium seen on the CME BTC futures contracts, this is in sync with the total open interest on the platform just recently setting fresh all-time highs which is again a healthy bullish signal (refer 3rd chart).

With these long hedges, one can leverage and would indeed cut down market exposure, mitigate risks, and equips with the ability to either add longs or short their spot market exposures in smaller tranches later on.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays