BTCUSD (at Coinbase) has rebounded back with 8.94% gains so far in this week. Although Bitcoin price has regained 2-3 days, it has been oscillating between tight range of $10k - $8k levels.

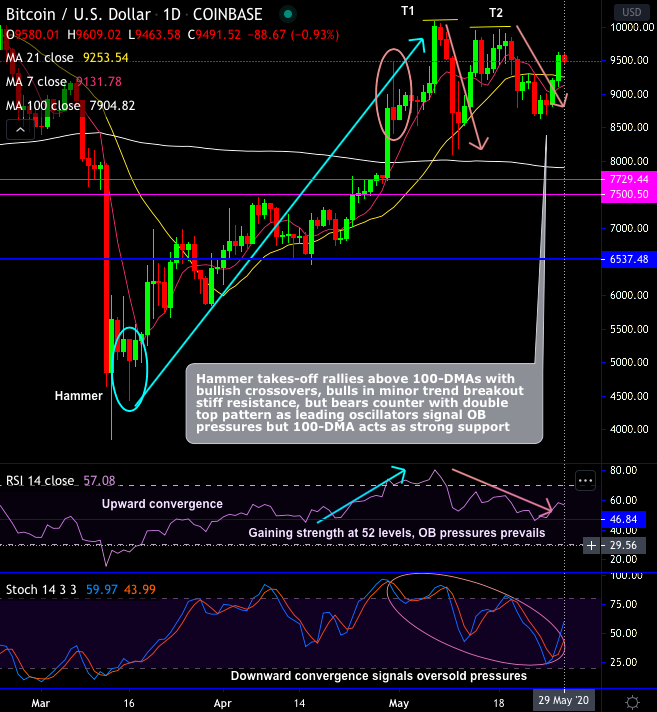

Technically, bulls have disrupted the formation of double top pattern, while hammer takes-off rallies above 100-DMAs with bullish crossovers. Bulls in minor trend breakout stiff resistance, but bears counter with double top pattern as leading oscillators signal overbought pressures but 100-DMA acts as strong support.

Since mid-March, BTC has spiked from $3,858 to the current $10,079 which is 160% rallies (refer monthly chart), it has now staged for 2nd consecutive months’ rallies.

While in recent times, the CME’s bitcoin derivatives products have sensed considerable growth with total open interest (OI) prints fresh all-time highs. The current BTC CME futures worth about $450 million in outstanding OI, showed a slight dip from recently observed highs of $532 million. Well, almost half of this OI flowed through both options and futures are set to expire on Friday, on the flip side, the roll-over of these contracts to future months that determines some turbulence in the pioneer cryptocurrency.

Amid such volatility, as we could foresee strong support at $7,900 levels (i.e. 100-DMAs), long hedges have already been advocated using CME BTC Futures when the underlying BTC was trading at $4,927 levels, and we wish to uphold the same positions. It is unwise to count the chickens before they hatch, if we keep speculating on the next upside target and accumulate fresh bitcoins. Instead, one can certainly uphold the above advocated long hedges for now (spot reference: 9,496 levels).

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges