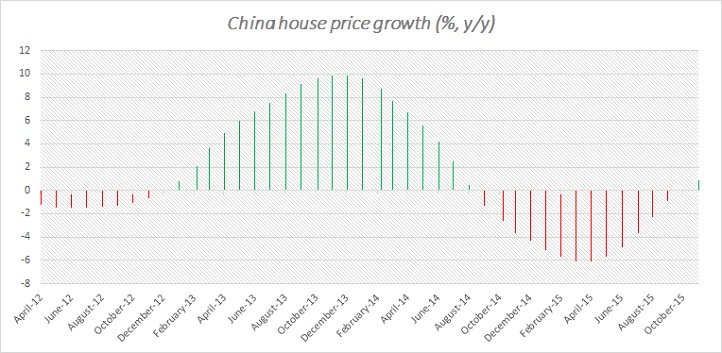

Life may be returning to China's ailed housing sector as prices moved up steadily for seventh consecutive month. Prices in 70 cities surveyed up by 0.3% in November, after rising 0.2% in October. On yearly basis prices have recovered from deflation to up by 0.9% in November.

Large chunk of the rises are due to price hump in Tier one cities. In capital Beijing up 7.7% from a year ago, while in financial hub Shanghai prices are up by 13.1%. While prices have jumped up solid in Tier one cities like Beijing, Shanghai, Guangzhou, Shenzhen, in some Tier three and four cities prices are in decline. Inventory still high in greater China.

Nevertheless this recovery and stabilization is broadly encouraging, since the construction sector contributes about 7% to GDP.

Some of the policy measures taken up, might be producing intended effect. People's Bank of China (PBoC) has cut rates six times in last 12 months and reduced down payment required for second house purchase thrice already.

Further measures are likely to come in 2016.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure