Russian Ruble is riding investor optimism stands as the best performing currency in 2015. Ruble dropped to new low for the year in overnight trade, currently floating at 51.4 against dollar.

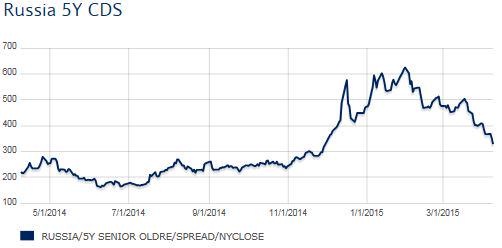

- Investors' optimism on Russia leading investors back to Russian fixed income assets, which saw substantial drop in Credit default swap (CDS). CDS acts as an insurance to bondholders, looking for protection from credit risk.

- Premium for insurance against default as measured by CDS, has fallen from 600 basis points to 300 basis points, however it is still above its average around 150-200 basis points.

Russian central bank, has used higher interest rates last year to tame the currency's fall against dollar. Rates were pushed towards 17% last year, however central banks has reduced interest rate this year to 14%, prompting rally in country's debt.

- Though further rate cuts are not out of radar, however that won't be easy to come by as inflation remains at more than a decade high around 17%.

In last three months alone Ruble has gained about 17% against dollar, however remains 44% down from a year ago.

Buyers are expected to remain large for USD/RUB around 50 level, and will pose psychological challenge for the pair.

Russian optimist will look to EU, whether it will renew the sanctions imposed that are about to expire mid of this year. All 28 members need to be agreed to renew sanctions. Any drop in sanctions, would be further bullish for Russian currency and bonds.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand