The Bank of Japan is likely to remain on hold at its first 2-day monetary policy meeting for 2017 scheduled to be held on January 31 amid signs of a more sure-footed economic recovery in Japan. Focus will be on the BOJ's move towards unwinding its monetary stimulus. About 40 percent of analysts polled by Reuters this month already expect the BOJ's next move will begin the retreat from its very loose monetary policy, up from 32 percent in December.

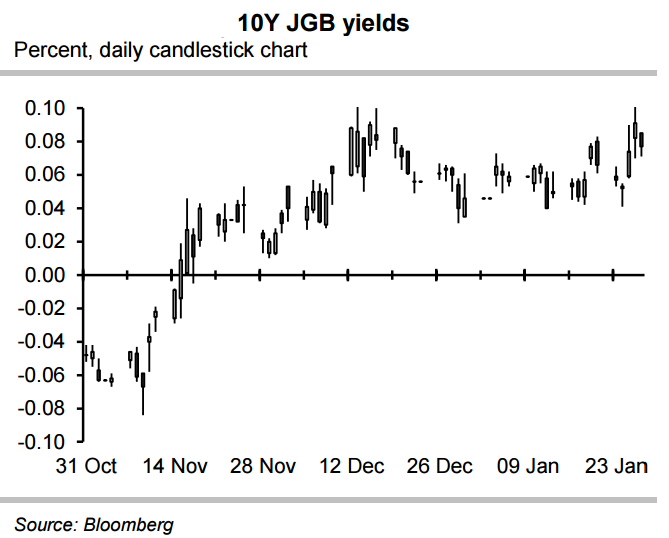

BOJ introduced a new policy target of "around zero percent" in the 10-year yield, in September. On Wednesday, the BOJ caught markets by surprise when it abruptly skipped a widely anticipated buying in shorter maturities and sent their yields soaring. The move raised expectations that the central bank might be preparing to taper its massive stimulus.

Earlier on Friday, the central bank wrong-footed markets by increasing its buying in five- to 10-year bonds, helping to bring down their yields from 11-month highs touched earlier this week. Today's increase in buying hardly makes up for the impact that market players had been expecting on Wednesday.

BOJ has said it would keep that pace of JGB purchase even under its yield curve control policy. The BOJ's total bond buying in January looks set to be around 8.2 trillion yen, the lowest since October 2014. It has to maintain an average of 9.4 trillion yen purchases to maintain its previous policy target to increase its bond holdings by 80 trillion yen a year.

December consumer price inflation data showed Japanese consumer prices rose 0.3 percent on year in December, above market expectations of 0.2 percent growth, down from prior 0.5 percent. The rise was largely driven by weaker yen and pickup in oil prices, raising questions on whether the expected gains in CPI will be sustainable.

The benchmark 10-year JGB yield, which tends to move less than other maturities because of the BOJ's policy to peg it around zero percent, was around 0.075 percent on Friday. USD/JPY was trading at 115.07, up 0.5% on the day. FxWirePro's hourly USD spot Index was at -4.09367(Neutral), while hourly JPY spot index was at -137.084 (Highly bearish) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty