Australian governments direct billions to fossil fuel companies. Among the projects funded by Commonwealth and state governments are work on coal ports, railways and power stations, and research into “clean coal” or “coal innovation”.

Whether worthwhile or not, this funding is visible and can be debated on its merits, as The Australia Institute has done in a study characterising total government support for fossil fuel industries as hitting A$10.3 billion in 2020-21.

But there’s more that’s invisible. Research I have just published in the journal Environmental Research Letters using new administrative data from tax offices finds Australia has spent more subsidising fossil fuel research indirectly via research and development tax credits than directly via grants.

Between 2012 and 2018 fossil fuel extraction companies received A$1.4 billion in research and development tax credits from the Australian government.

My study examines the R&D tax concessions taken up in Canada, Australia, Norway and the United Kingdom.

Support through tax concessions is near-invisible

Each country has committed to reduce greenhouse gas emissions. All are part of the international Mission Innovation initiative, which aims to accelerate the development and diffusion of low-carbon technologies.

The tax data provided was the value of R&D tax credits received by companies whose principal classification code is, or has recently been, related to fossil fuel extraction.

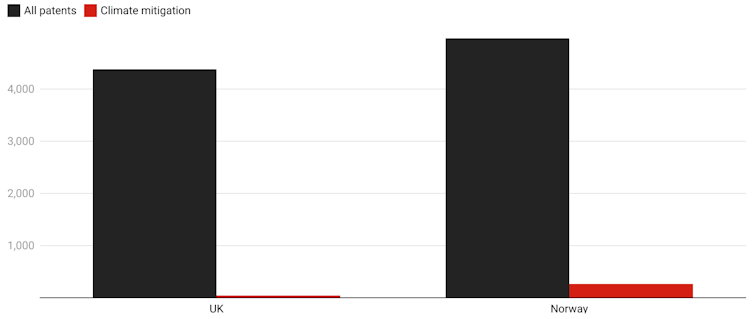

Because some of these grants might have been used to support research into renewable or carbon sequestration technologies, I have also examined the nature of the patents published by those companies in the countries where it is available.

Of the 9,398 patents filed by UK and Norwegian fossil fuel extraction firms between 2012 and 2018, only 3% are related to climate mitigation. I was unable to obtain figures for Australia.

Most patents claimed by fossil fuel extraction companies are for fossil fuels

Number of patents filed between 2012 and 2019 by UK and Norwegian firms whose principal activity is fossil fuel extraction. McDowall 2021

This generous support of fossil fuel innovation through R&D tax credits is unlikely to be deliberate. It is an artefact of the design of Australia’s R&D tax incentive scheme, which is unusually generous to large companies.

But it amounts to a surprisingly big amount, and longer term could be bigger still.

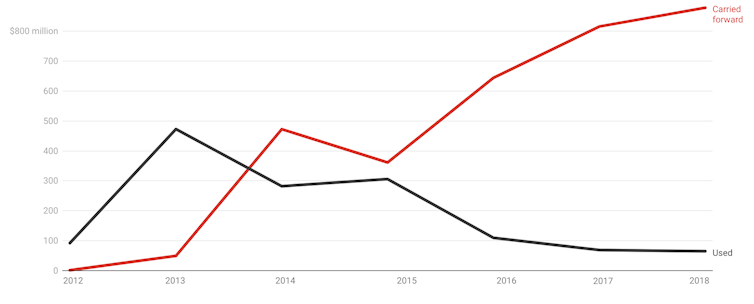

Much support is banked for future use

Australia’s credits can be “carried forward” to reduce future tax bills.

In 2018, the most recent year for which data was available, Australian fossil fuel companies were holding on to A$880 million in R&D tax credits that could be used in future years on top of what they had claimed.

That’s in addition to the A$1.4 billion already received, for a total of well over A$2 billion. It’s a substantial well-hidden public investment in fossil fuel R&D.

Australian fossil fuel companies are amassing credits to carry forward

Although done rarely, it is possible to design R&D tax concessions differently.

Between 2003 and 2017, the UK offered a higher rate of R&D tax credits for research on vaccines, malaria, tuberculosis and HIV/AIDS. Several states in the United States offer higher R&D tax credits for research on particular technologies.

A better and more open approach would be to replace R&D tax concessions for fossil fuel research with direct grants for lines of research that might help Australia meet its emission reduction commitments.

Research into cheaper ways of producing fossil fuels will be counter-productive to those efforts. It will create the need for higher carbon prices or other measures down the track to re-tilt the playing field.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock