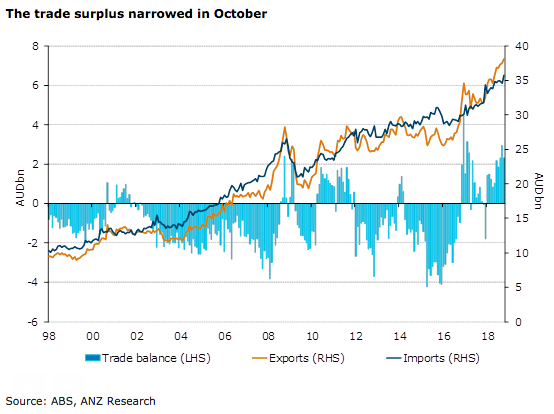

Australia’s trade balance for the month of October deteriorated, owing to improvements in imports of capital goods and intermediate goods, which is consistent with the solid pipeline of business investment and government infrastructure projects. Export growth was supported by a large increase the value of coal exports.

The monthly trade balance deteriorated to a surplus of AUD2,316 million in October. September’s surplus was revised slightly lower to AUD2,940 million (from AUD3,017 million). October’s change reflects a 3.2 percent m/m increase in imports and a 1.3 percent increase in exports.

Total export values were up 20 percent y/y. Resource exports were up 2.5 percent m/m, led by a 12.5 percent surge in coal, while other mineral fuels rose 4.1 percent and metal ores and minerals fell 0.6 percent.

Manufactured goods rose 5.4 percent, with machinery up 3.7 percent. Rural goods fell, likely reflecting the impact of the eastern drought, with cereals and grains down 15.4 percent. Service exports rose 1.1 percent as freight transport increased 8.7 percent and travel rose 2.3 percent.

Total imports rose 13 percent y/y. Intermediate and other merchandise was the largest contributor to the monthly rise, up 4.8 percent m/m. Within this, fuel and lubricants rose 11 percent.

Meanwhile, capital goods increased 7.8 percent, with telecommunications equipment rising 12.6 percent and machinery and equipment increasing 5.6 percent. Consumption goods rose 1.2 percent, with textiles, clothing and footwear up 4.7 percent and household electrical items up 1.9 percent. Service imports fell 0.3 percent, with travel falling at the same rate.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains