Australia’s September quarter consumer price inflation (CPI) data released earlier on Wednesday showed that headline CPI rose by 0.7 percent for the third quarter, beating expectations for an increase of 0.5 percent and was higher than the 0.4 percent level reported in the June quarter.

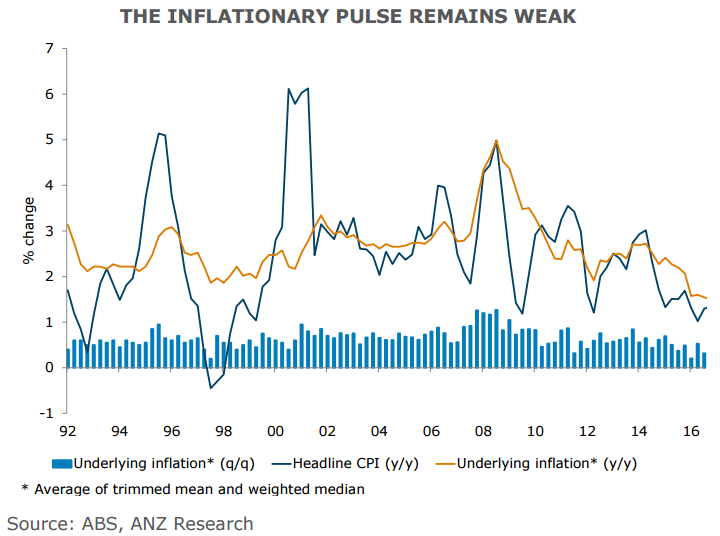

Meanwhile, underlying inflationary pressures remain soft with the average of the two underlying measures rising by 0.32 percent q/q. In annual terms, core inflation rose by 1.5 percent, slightly weaker than the previous quarter’s 1.6 percent rise. CPI ex-volatiles in seasonally adjusted terms rose a soft 0.3 percent q/q.

"The RBA would likely be disquieted by the soft tone for underlying inflation. On this data, it is too early to conclude that disinflationary pressures are abating or even stabilising," said ANZ in a report to clients.

Details of the report showed that significant price rises from fruit (+19.5 percent), vegetables (+5.9 percent), electricity (+5.4 percent) and tobacco (+2.3 percent) were partially offset by falls in communication (-2.3 percent) and fuel (-2.9 percent). It is worth noting that factors pushing up inflation in the quarter, including fruit and vegetables, tend to be volatile and transitory.

Tradable inflation which accounts for 40 percent of the ABS’ CPI basket rose by 1 percent for the quarter. Non-tradable inflation accounting for the remaining 60 percent of the basket rose by a smaller 0.5 percent.

"Today’s data may not be enough of a downside shock for the RBA. Indeed, we note that while very low, inflation is not inconsistent with the RBA’s forecasts published in August. With some hesitation, we continue to expect that the RBA will lower official interest rates by 25 basis points when it meets next week on Tuesday, but admit that it will be a very close call," said St George Economics in a report.

AUD/USD spiked to hit new highs for the week at 0.7709 after upbeat CPI data. The pair, however, failed to hold the 0.77 handle and slipped lower to trade at 0.7670 at around 11:30 GMT. Downside currently finds strong support at 50-DMA (0.76). We see weakness only on break below. Next major hurdle on the upside aligns at 0.7740 (trendline).

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility