Airbus recently secured orders for 65 jets from two of Boeing's vital Asian customers, marking a significant win for the European planemaker amidst challenges faced by its U.S. rival. The orders come when Boeing grapples with quality issues, including a mid-flight panel blowout on a 737 MAX 9 jet.

Japan Airlines Chooses Airbus Over Boeing

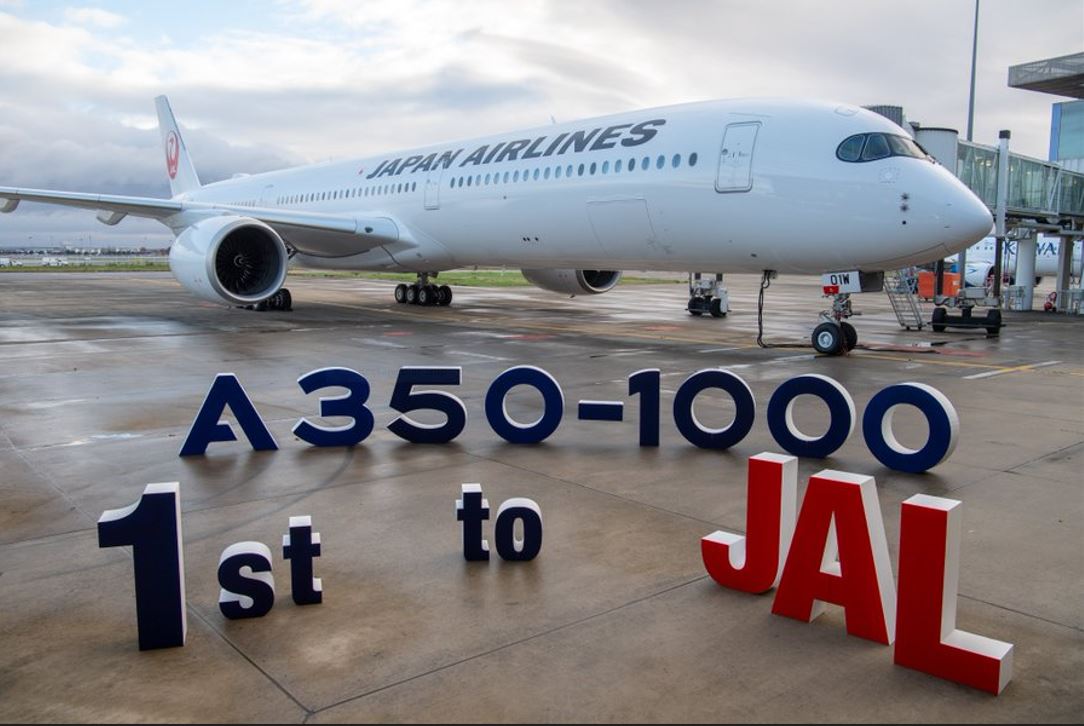

As per Yahoo, Japan Airlines (JAL) announced plans to purchase 21 wide-body A350-900 and 11 A321neo narrow-body jets from Airbus. This marks the first time the longtime Boeing customer will receive smaller single-aisle jets from Airbus. This decision dealt a blow to Boeing as it navigated a manufacturing crisis, leading to limitations in narrow-body jet production.

JAL's order allows Airbus to strengthen its presence in a market segment traditionally dominated by Boeing. This order from Japan's second-largest airline follows Airbus's initial breakthrough order of A350 wide-body jets over a decade ago.

Korean Air Joins the Airbus Family

Korean Air, South Korea's largest carrier, also opted for Airbus by ordering 33 A350s in a $13.7 billion deal. This decision marks Korean Air's first purchase of the Airbus A350 family as it prepares for a merger with Asiana Airlines, another major South Korean carrier.

Airbus's Market Share Growth

Airbus has steadily increased its single-aisle market share with the A321neo, particularly after the Boeing 737 MAX crisis. These include two fatal crashes in 2018 and 2019, significantly impacting Boeing's reputation and market standing.

Business Recorder noted that despite Boeing's claims of holding 65% of the in-service market share in Northeast Asia, Airbus's recent success with Asian carriers highlights the growing competition in the region. The limited number of Boeing orders is not directly linked to the ongoing quality concerns but reflects a broader trend in the aviation industry.

Market Dynamics in the Aviation Sector

Airbus and Boeing are competing in a tightening market for efficient, long-haul aircraft as international travel gradually recovers from the impact of the global pandemic. This has increased demand for modern, fuel-efficient jets that meet evolving travel needs.

JAL expects deliveries for the ordered jets between the 2025 and 2033 financial years, with a total catalog price of approximately $12.4 billion. An extra A350-900 will also replace a jet destroyed in a runway collision at Haneda Airport in Tokyo.

Photo: Airbus Newsroom on X

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Champions League final 2025: a battle for glory against a backdrop of money and fashion

Champions League final 2025: a battle for glory against a backdrop of money and fashion  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  ‘The geezer game’ – a nearly 50-year-old pickup basketball game – reveals its secrets to longevity

‘The geezer game’ – a nearly 50-year-old pickup basketball game – reveals its secrets to longevity  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Trump Draws Cheers at Ryder Cup as U.S. Trails Europe After Opening Day

Trump Draws Cheers at Ryder Cup as U.S. Trails Europe After Opening Day  Extreme heat, flooding, wildfires – Colorado’s formerly incarcerated people on the hazards they faced behind bars

Extreme heat, flooding, wildfires – Colorado’s formerly incarcerated people on the hazards they faced behind bars  Trump's Transgender Sports Ban Faces Enforcement Challenges

Trump's Transgender Sports Ban Faces Enforcement Challenges  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks