Federal Open Market Committee (FOMC) will announce monetary policy decisions today at 19:00 GMT at the end of its two-day monetary policy meeting. It is widely expected that the FOMC members would vote to hike rates by 25 basis points at today’s announcement.

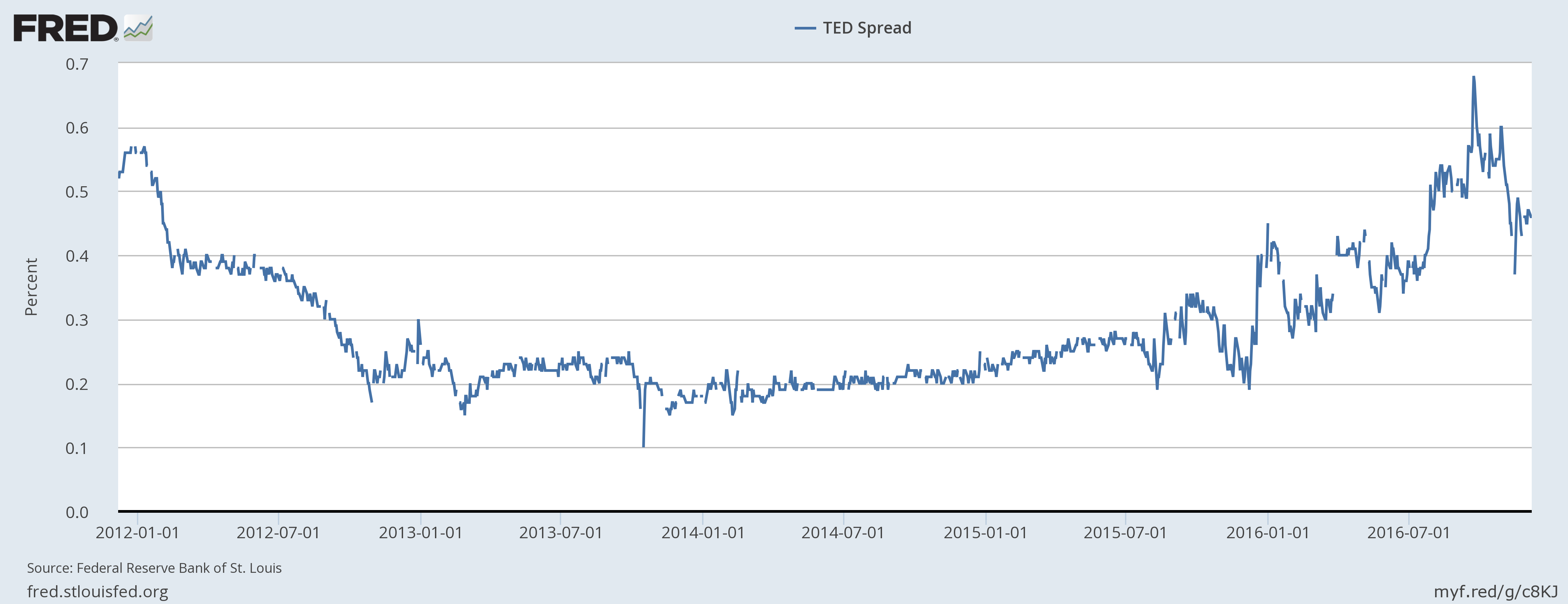

We, at FxWirePro, would keep a close watch over the next few days on the TED spread along with some other instruments. TED spread is the difference between the yield on 3-month Treasury bill and rates on interbank loans, which is represented by London Interbank Offered Rate (LIBOR). LIBOR bottomed in 2014 around 0.22 percent and jumped sharply from 0.32 percent to 0.61 percent in late 2015. After consolidating through the early half of the year, 3-month USD LIBOR started rising from 0.62 percent in July to 0.96 percent as of now, which is the highest level since the 2008/09 crisis. Similar rise happened last year before the Fed hike of 25 basis points in December, if that is the case then there is little to worry other than the higher interest rates. But if LIBOR continues to rise along with the TED spread, which can be read as the market demanded risk premium for holding loans other than the secured treasuries, it could point to funding shortage in the market along with the rise in the risk perception.

We don’t suspect that being the case, especially since the TED spread after reaching 0.68 percent in September, the highest level since May 2009 has declined to 0.45 percent. We suspect that the treasuries have been late to react to the possibility of a hike. Nevertheless, the spread demands a close scrutiny after the Fed over next couple of weeks.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility