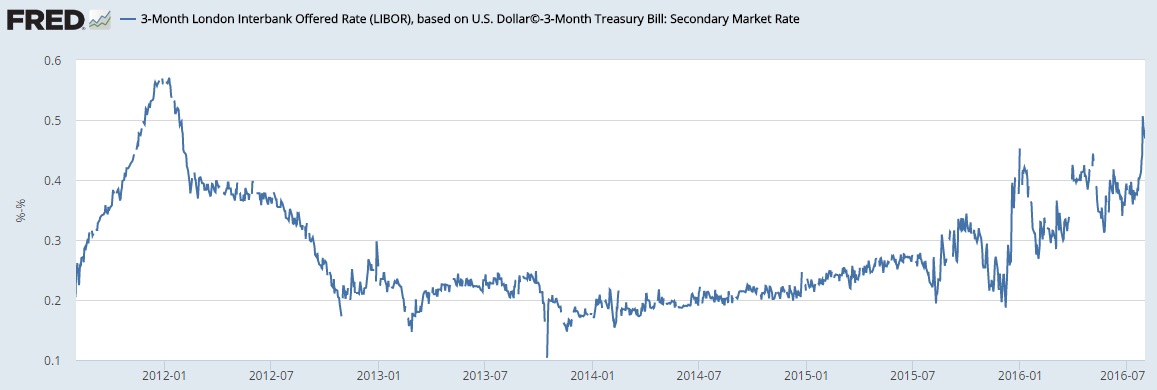

The cost of unsecured U.S. Dollar funding is creeping up and it has been creeping up since 2014, however, recent days have seen a relatively sharp jump in that cost not seen in years. The spread between the risk-free rates, which is treasury rate and the cost of unsecured funding (Libor) at which banks borrow from each other has moved to the highest level in more than four years. The spread is currently hovering around 50 basis points, which is highest since January 2012. If that spread past beyond 57 basis points, which we think it will, that would be the highest since the 2008/09 crisis.

This spread, which is popularly known as TED spread, was at 33 basis points in February 2007, from where it jumped above 2 percent by the end of the year and reached 3.16 percent at the peak of the crisis. This time, however, we feel that there could be chronic shortages of the dollar funding, which would lead to the rise in the spread but relatively slowly.

It is also important to note that, since the financial crisis, record easing from the U.S. Fed led to the formation of a close relation between the effective federal funds rate and Libor but if the new trend persists and the spread kept widening it would imply that despite all the easing Fed has lost its grip on the risk premia in the market. A large part of the blame could also be attributed to the new regulatory framework that has led to the shrinkage in dollar-based funding available via money market funds.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.