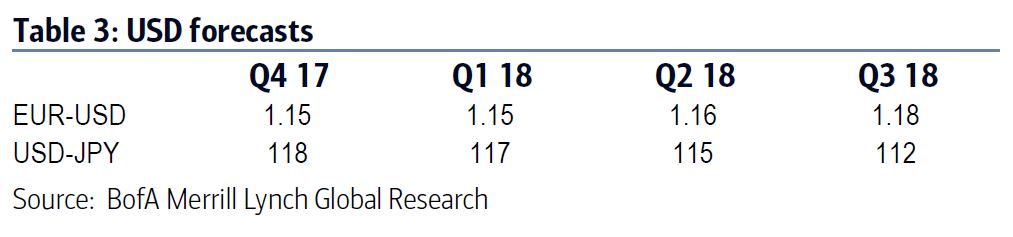

The US dollar is expected to strengthen more by the end of this year, according to a recent report from Bank of America Merill Lynch (BofAML). While EURUSD was testing levels above 1.20, a drop to 1.15 is projected by the end of the year. This is based on expectations for a dovish ECB and a hawkish Fed, both of which have now come true. There is still uncertainty about the Fed's policy reaction function after changes in its leadership, but it can be assumed that the main goals will remain the same.

As a result, markets are expected to move closer to the three hikes that the dot plot sees for next year. Technicals have also turned bullish for the USD. Whether or not the tax reform will take place or not in the US is unknown, but if it does happen, profit repatriation will be very bullish for the USD.

Estimates suggest that perhaps 40 percent of the money the US companies have abroad is in non-USD currencies. Even if half of this money is repatriated, and taking the lowest end of this range, the USD could appreciate by 5-10 percent, consistent with the move following the 2005 HIA.

"We continue to expect the USD to strengthen more by end-2017, with potentially much further upside to our projections if tax reform becomes more likely. The market is short the USD. This position is not stretched with respect to other G10 currencies, but it is stretched with respect to most EM currencies. The USD remains slightly above its long-term equilibrium, but we don't expect valuation to be a constraint if monetary policies continue diverging," BofAML commented in its latest research report.

Timing is a risk, as it could take longer for the market to converge to the dot plot and to get clarity on tax reform. If there is no agreement on the debt ceiling in December, tail risks scenarios could unfold, initially weakening the USD as the Fed could stay on hold in December. However, the analysis points to asymmetric upside risks from profit repatriation if US tax reform goes ahead, the report added.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility