Despite market optimism being reflected through the stock market rise, the trade war initiated by the U.S. President Donald Trump continues under the rug. Since President Trump announced 25 percent tariffs on all steel imports and 10 percent tariffs on all Aluminum imports, several countries like India, Mexico, China, and Russia have announced countermeasures. The European Union has also joined in the war by announcing retaliatory tariffs on U.S. imports. In addition to that, both China and the United States have announced a 25 percent tariff on imports worth $50 billion, with more to follow.

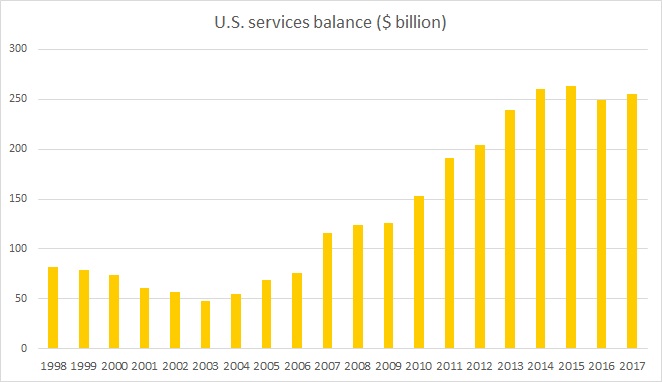

So far, the tariffs have largely be announced on goods. However, with the United States running $550 billion goods deficit with the rest of the world, the foreign retaliation could soon target U.S. services, where the U.S. enjoys a sizable surplus. During her speech at Bundestag, German Chancellor Angela Merkel has raised this point several times since the onset of the trade war.

The chart shows the U.S. services balance with the rest of the world. According to data from the census bureau, the U.S. services surplus with rest of the world was $255.2 billion in 2017.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength