The United States economy is currently in a solid expansion state and for the first time since the 2008/09 ‘Great Recession,’ the U.S. is close to expanding at its long-term growth rate of 3.25 percent. While the uncertainties surrounding the U.S. mid-term election, President Trump’s Iran policies, and trade tension led to a loss of trillions of dollars in the stock market in October, hard data suggest that the economy remains well into an expansionary phase.

In October, the U.S. benchmark stock index, S&P 500 declined sharply from its high of about 8 percent, pushing the index (SPX500) from 2940 to 2700 area, but at the same time job numbers continued to point to solid expansion.

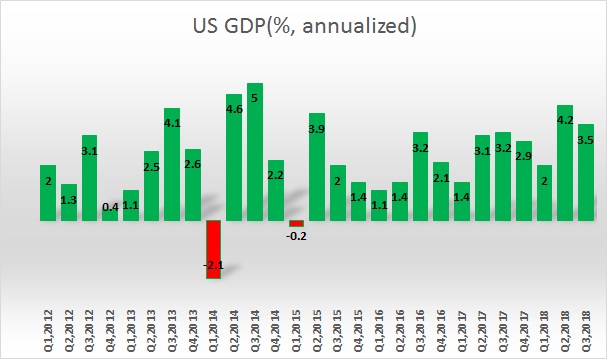

According to data from ADP, the U.S. economy added 227,000 new jobs in October, with 38,000 jobs being created in the goods-producing sectors. The GDP estimate also points to expansion. According to the latest reading, Atlanta Fed’s ‘GDP Now’ model is forecasting a 3 percent growth in the final quarter of the year, revised up from 2.6 percent. The U.S. economy has growth 2 percent in the first quarter of 2018, 4.2 percent in the second, and by 3.5 percent in the third quarter of this year.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market