When aspiring for Presidency, then-candidate Donald Trump promised to bring back manufacturing jobs back to the United States, which according to him, left because of the unfair trade deals and practices by many countries like China, India, and the European Union.

Since becoming President, Trump has enacted policies to make the trade agreements and trade practices fairer, and so far, it has born fruits.

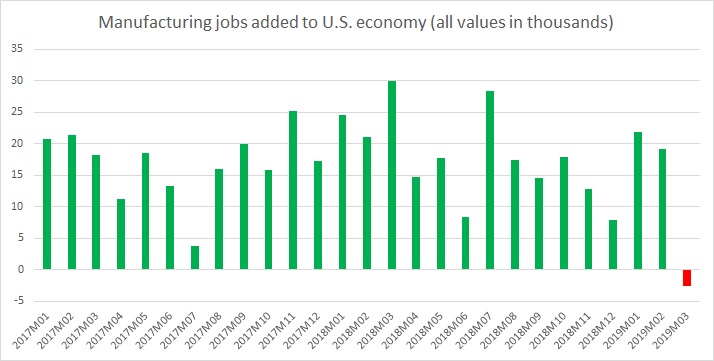

However, since the last quarter of 2018, the U.S. economy has slowed down and March ADP report pose concerns that the slowdown has started hurting the U.S. economy and its manufacturing sector, amid heightened trade tensions.

For the first time since president Trump took to the office, the manufacturing sector lost 2,000 jobs in March. However, under his Presidency, 456,000 jobs in the manufacturing sector, more than those created under President Obama’s second term. So, March numbers could only be a minor deviation. Nevertheless, it makes April payroll report of extreme importance to assess whether this job loss was a one-time deviation or is it a new trend?

In addition to yesterday's dismal manufacturing payroll numbers, U.S. ISM non-manufacturing index has declined 3.6 percent in March, adding to the fear of a slowdown.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals