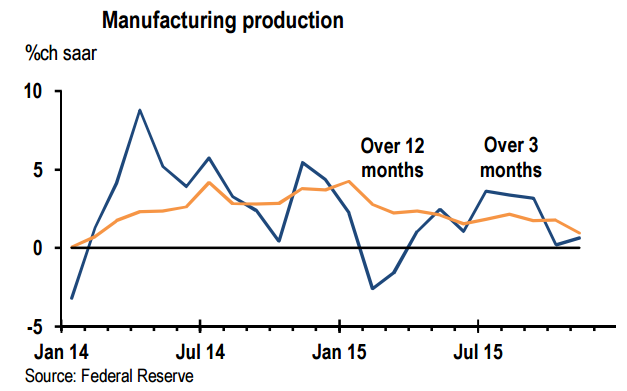

The November IP report confirmed that manufacturing continues to underperform the overall economy. Total manufacturing output was flat in November and non-auto output increased 0.1% samr. This leaves total manufacturing up only 0.8% saar so far in 4Q15 and non-auto manufacturing up 1.1%. These anemic quarterly growth rates are close to the trend in output growth over the first 11 months of the year, 1.1% saar for all manufacturing and 0.6% for non-auto manufacturing.

Moreover, December manufacturing surveys to date point to continued weakness through the end of the year. The PMI had been holding up better than other surveys, but the flash PMI for December dropped to 51.3, its lowest reading since October 2012. The key new orders component dropped to 50.5, its lowest reading since September 2009. Results from the first regional Fed surveys for December were also generally downbeat, in line with the tone of the PMI.

US manufacturing still struggling

Monday, December 21, 2015 11:39 PM UTC

Editor's Picks

- Market Data

Most Popular

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  S&P 500 Rises as AI Stocks and Small Caps Rally on Strong Earnings Outlook

S&P 500 Rises as AI Stocks and Small Caps Rally on Strong Earnings Outlook  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold, Silver, and Platinum Rally as Precious Metals Recover from Sharp Selloff

Gold, Silver, and Platinum Rally as Precious Metals Recover from Sharp Selloff  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure  Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China

Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China  Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs

Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs  Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound

Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound  South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target

South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target