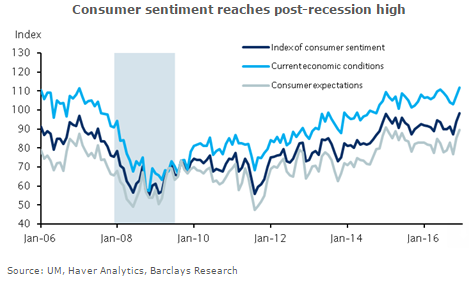

Consumer sentiment in the United States reached post-recession high during the month of December, post the victory of U.S. President-elect Donald Trump and expectations of a protectionist policy by him.

The University of Michigan index of consumer sentiment was revised slightly higher in the final December estimate to 98.2, from 98.0 and reached a post-recession high. The current conditions index was revised slightly lower to 111.9 (previous: 112.1), while the expectations index was revised higher to 89.5 (88.9).

Both short- and longer-term inflation expectations were revised lower, to 2.2 and 2.3 percent, from 2.3 and 2.5 percent respectively. Inflation expectations in this survey remain soft and the latest decline brings the longer-run measure to its historical low.

"Ongoing solid readings on consumer confidence reinforce our view that GDP growth should remain firm in the near term, and we see the level of confidence as consistent with ongoing strength in consumer spending," Barclays Research said in its latest research note.

Meanwhile, the dollar index traded at 102.87, down -0.14 percent, while at 6:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -14.80 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran