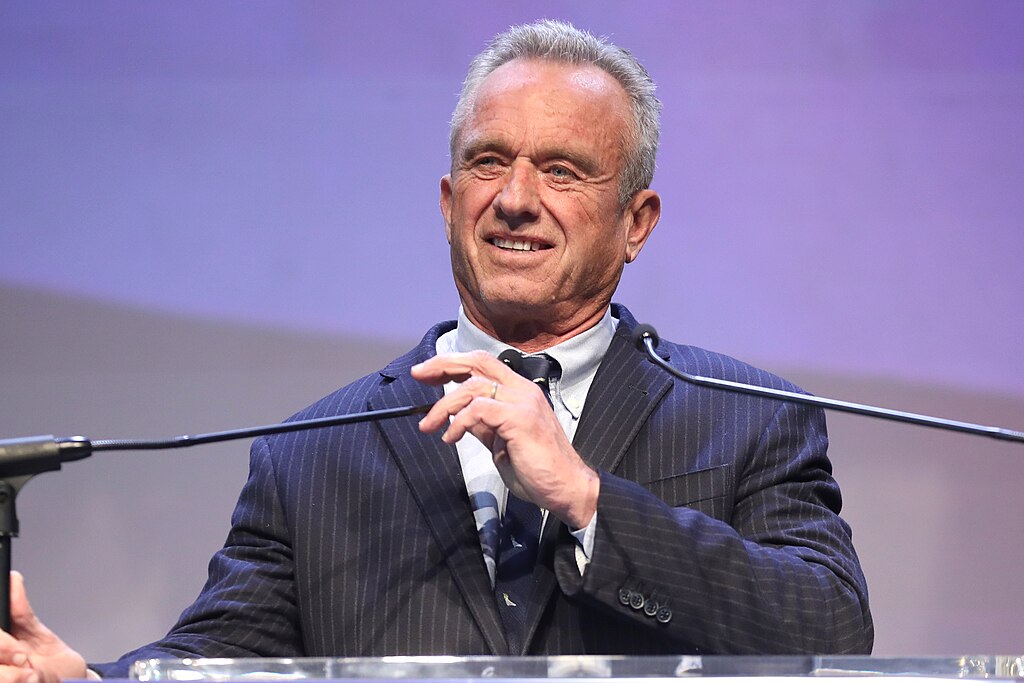

Sweeping changes to U.S. vaccine policy under Health Secretary Robert F. Kennedy Jr. are creating uncertainty across the pharmaceutical sector, dampening investor confidence and raising concerns among vaccine manufacturers. Since President Donald Trump’s administration reshaped federal health leadership, long-standing vaccine recommendations have been rolled back, marking a significant shift in public health strategy that is already affecting vaccine demand, company revenues, and long-term investment outlooks.

Over the past year, the U.S. has ended broad guidance that previously recommended routine childhood immunizations for illnesses such as influenza and hepatitis A. Additional changes include scaling back COVID-19 vaccine recommendations for pregnant women and children, altering childhood vaccine schedules, and replacing independent advisory panels with members more aligned with Kennedy’s long-held skepticism toward vaccines. These moves, which Kennedy says are aimed at improving safety and aligning U.S. policy with other nations, have alarmed public health experts and the biotech industry alike.

Investors and analysts note that vaccine makers now face increased political risk. Many initially viewed Kennedy’s appointment as a short-term headline issue, but as policy changes have translated into lower vaccination rates, the impact has become more tangible. Analysts warn that vaccines may no longer be seen as a reliable growth segment under the current administration, potentially weighing on the sector through at least 2028.

Major pharmaceutical companies such as GSK, Sanofi, Pfizer, and Merck are better positioned to absorb the impact due to diversified revenue streams. However, smaller vaccine-focused biotech firms like Moderna, BioNTech, and Novavax face heightened exposure. Recent earnings reports already show signs of strain, with lower U.S. flu vaccine sales reported despite a severe flu season. Outside the U.S., companies have also reacted to declining vaccination rates, citing increased volatility in the global vaccine market.

While many investors believe long-term demand for vaccines will recover—especially if disease outbreaks intensify—near-term uncertainty remains a drag on investment. Ongoing legal challenges from medical organizations and shifting public sentiment add further unpredictability. For now, changing U.S. vaccine policy and rising skepticism are reshaping the risk calculus for vaccine makers and investors, making the market less predictable than it has been in decades.

Novo Nordisk and Eli Lilly Cut Obesity Drug Prices in China as Competition Intensifies

Novo Nordisk and Eli Lilly Cut Obesity Drug Prices in China as Competition Intensifies  Sanofi to Acquire Dynavax in $2.2 Billion Deal to Strengthen Vaccine Portfolio

Sanofi to Acquire Dynavax in $2.2 Billion Deal to Strengthen Vaccine Portfolio  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  Vanda Pharmaceuticals Wins FDA Approval for New Motion Sickness Drug After Four Decades

Vanda Pharmaceuticals Wins FDA Approval for New Motion Sickness Drug After Four Decades  Novo Nordisk Stock Surges After FDA Approves Wegovy Pill for Weight Loss

Novo Nordisk Stock Surges After FDA Approves Wegovy Pill for Weight Loss  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns

Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns  California Jury Awards $40 Million in Johnson & Johnson Talc Cancer Lawsuit

California Jury Awards $40 Million in Johnson & Johnson Talc Cancer Lawsuit