The US Federal Reserve raised interest rates by 0.25 percent for the third time in about seven months at its last meeting in June. Investors look ahead to next week’s FOMC monetary policy announcement at the 25th-26th July policy meeting. With no policy change expected in July, the focus for markets will be on whether the Fed sends any new signals about its intentions for the rest of the year.

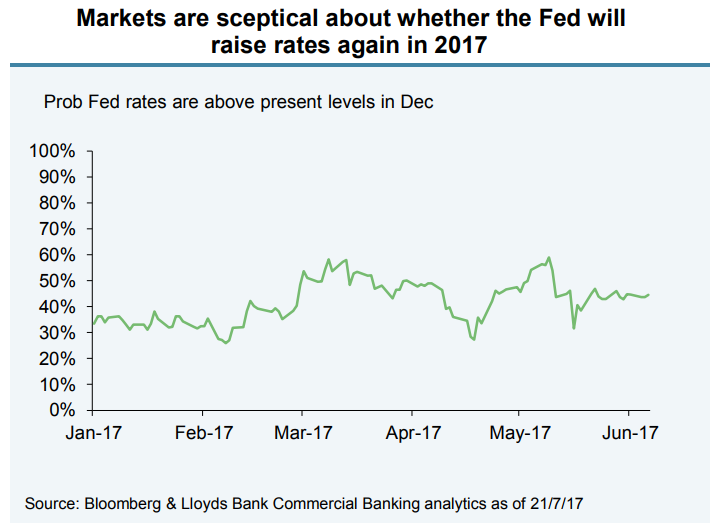

Headline CPI inflation slipped for the fourth consecutive month, driven in part by the slippage in the oil price, but also reflects an easing in ‘core’ inflation. Inflation as measured by the Fed’s preferred measure, ‘core’ consumer expenditure deflator, has fallen to 1.4 percent from 1.8 percent at the start of the year. This leaves it well below the Fed’s inflation target of 2.0 percent. The unexpected deceleration in core CPI inflation is raising skepticism about whether the Fed will raise rates again in 2017.

Fed’s policy making committee on the other hand regard the inflation dip as temporary and driven in part by “unusual reductions” in certain prices. FOMC members expect strong economic growth will continue to tighten labour market conditions and will eventually lead to a pickup in inflation. Nevertheless, Fed Chair Yellen did acknowledge in her recent bi-annual testimony that the inflation situation needs to be “carefully monitored”.

Fed funds futures continue to show less than a 50 percent chance of a rate hike in December in the wake of Fed Chair Janet Yellen's cautious stance on tightening. The policy meeting will not ne followed by a press conference, nor are there any forecast updates. The press statement is also expected to show little changes from the June statement.

"We expect the US Federal Reserve to leave its policy interest rates unchanged at its 25th-26th July policy meeting. With financial markets attaching virtually a zero probability to a July monetary policy change, any move would be a huge surprise. But we see no reason why the Fed would want to deviate from market expectations," said Lloyds Bank in a report.

Dollar index extends downside, hits 12-month lows at 93.99. EURUSD hits fresh 14-month high yesterday after positive comments from Draghi in ECB monetary policy meeting. Near term support stands around 1.15879 (23.6% retracement of 1.13123 and 1.1679) and any break below will drag the pair down till 1.1528 (5- day MA). Any minor weakness can be seen only below 1.1480 (yesterday low). The near term resistance is around 1.17140 and break above will take the pair till 1.17420 (38.2 % retracement of 1.7420 (38.2% fibo)/1.1800.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks