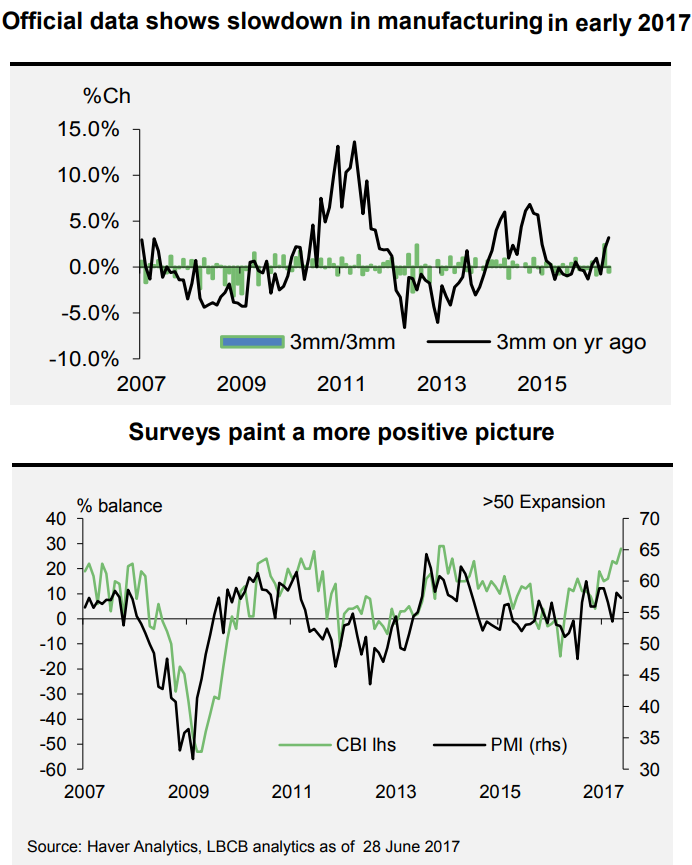

UK second quarter started off on a bad note as the manufacturing and construction sectors performed poorly in April. Office for National Statistics data showed that manufacturing rose by just 0.2 percent in the month, while construction output dropped by 1.6 percent. The drop came in despite purchasing managers’ index surveys suggesting an improvement in momentum in April. Data suggests that GDP growth in Q2 may not see a big improvement as previously thought.

That said, the extent of slowdown is probably exaggerated as it follows what looks to have been erratically strong rises in November and December of year 2016. Manufacturing activity has picked up across a number of other economies in the eurozone in the recent months. The US also started the year on a firm footing. This suggests that there has been a rebound in demand for manufactured goods

Business surveys also point to a rise in export orders which indicates that international demand for UK manufactured goods is rising. UK trade data showed that exports stayed flat at £49.8bn in April while imports dipped from £53.7bn to £51.9bn, narrowing the deficit to £2.1bn. Volatility in monthly trade data cannot be ruled out as large orders of goods such as aircraft can sway the national figures. A combination of stronger world trade growth and the competiveness boost that should follow from sterling’s depreciation of last year are positive signals for manufacturing exports.

Meanwhile, manufacturing continues to face a number of headwinds including difficulties in recruiting staff, sluggish productivity growth and ongoing concerns about the impact of Brexit. Employers face a triple whammy of uncertainty over the last few months – a snap election, the triggering of article 50, and weak economic data for the first half of 2017. Surveys showed stark contrasts between sectors. Manufacturers were most optimistic about hiring but the outlook for the public sector was far gloomier, with a majority of employers looking to cut jobs.

"Recent manufacturing performance has been patchy due to variable impacts from sterling depreciation, a slowing domestic market and an uneven international upturn. Business surveys, however, paint a rosier picture including robust orders growth. This suggests that any slowdown will be temporary," said Lloyds Bank in a report.

GBP/USD was trading range bound at around 1.2819 at 1145 GMT. Technical indicators are bullish and we see scope for further gains. The pair closed above 20-day MA and now finds stiff resistance at cloud top. Break above will confirm further bullishness. FxWirePro's Hourly GBP Spot Index was at 31.8402 (Neutral), while Hourly USD Spot Index was at -61.7679 (Slightly bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary