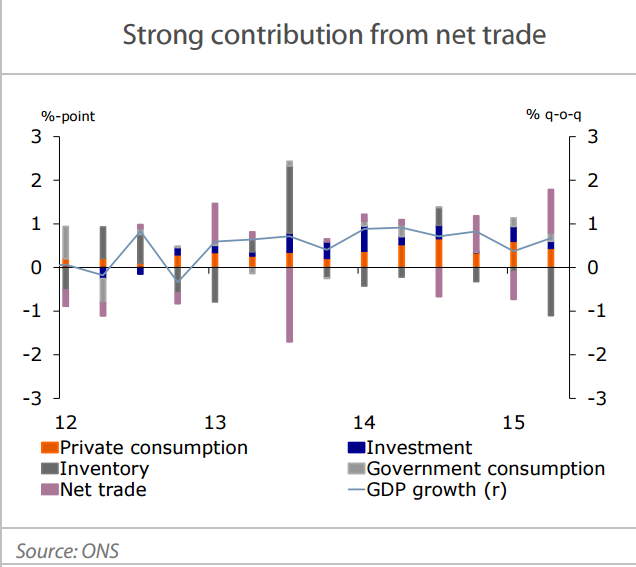

The second estimate of GDP in 2015Q2 confirmed that the British economy expanded by 0.7% q-o-q in the second quarter of 2015. All components, except inventory formation, contributed positively to economic growth. Private consumption increased by 0.7% q-o-q and investment by 0.9%. The latter was mainly driven by business investments, which increased by 2.9% q-o-q. Housing investment, on the other hand, shrunk by 3.5%. But most notable was the 3.9% q-o-q increase of exports. Since imports increased only 0.6% q-o-q, net trade contributed 1% to economic growth. However, this support is not expected to last, since British firms will likely suffer from the strong pound sterling compared to the euro, which will make British products relatively more expensive for the eurozone.

Furthermore, lower productivity growth over the last couple of years -compared to competitors in the United States and Europe- might hurt export performance going forward. On average, nominal wages increased by 2% over the last year, while labour productivity all but stagnated in 2014 (+0.1%). A strong decrease in export orders for July, according to the CBI survey, support the view of a slowdown in export growth in 2016.

UK economic growth in Q2 widely supported

Wednesday, September 2, 2015 10:48 PM UTC

Editor's Picks

- Market Data

Most Popular

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal