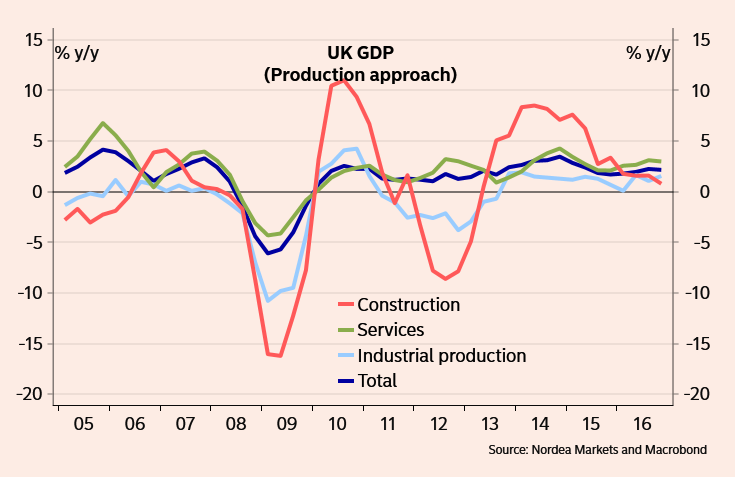

UK growth figures for Q4 confirm resilience of UK economy. Data released by the Office for National Statistics (ONS), showed preliminary estimate of UK Q4 GDP rose 0.6 percent q/q, the same growth rate as in the two previous quarters and above the 0.5 percent consensus forecast.

GDP growth was above the Bank of England’s estimate of a 0.4 percent rise in its November Inflation Report. Q4 reading taken in conjunction with Q3’s gain suggests UK economy grew faster in the six months following the Brexit vote than it did in the six months preceding the vote. Annualised GDP reads at 2.2 percent confirming the UK as one of the fastest-growing major economies in the world.

However, analysts warn weaker sterling and higher inflation will weigh on UK's economy and Britain is headed for a sharp slowdown in 2017. UK inflation is already at 2 1/2 year highs and expected to rise further. Rising inflation is likely to dampen consumer spending which has been the main momentum behind the UK’s continued growth. The Bank of England expects the weak pound to continue to raise import costs and for some of that to be passed on to consumers, squeezing their spending power.

“Looking forward, we do anticipate a slowdown in economic growth, principally because we see the post-referendum fall in the pound pushing up on import prices, in turn raising the CPI inflation rate to more than 3% later this year. That will squeeze household spending power.” said Chris Hare, economist at the bank Investec.

Britain could face a tougher time in the long-term amid “tough and prolonged” Brexit negotiations with the European Union. Last week’s speech by Prime Minister Theresa May only made it clearer that a hard Brexit is on the cards. The UK finance minister Hammond expressing his take on the Q4 GDP report said that GDP figures show fundamental strength and resilience of economy. Some uncertainty could lie ahead as the country adjusts to its new relationship with its European counterparts, Hammond added.

"The solid activity data support our view that the Bank of England will keep monetary policy on hold. Given our forecast of a slowdown in growth during 2017 we continue to expect the bank to look through an expected rise in inflation to well above the 2% target as the effect of the GDP feeds more through to consumer prices." said Nordea Bank in a report.

GBP/USD was trading at 1.2589, down 0.32 percent on the day, while EUR/GBP was at 0.8525 up 0.20 percent. FxWirePro's Hourly GBP Spot Index was at 46.799 (Neutral) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves